Stop Squirrely Sellers from Backing Out with this Simple 1-Pager [Free Download]

Dealmakers: Have you ever had a sweet deal under contract to buy, only to have the seller suddenly decide for whatever reason not play ball with you anymore?

Dealmakers: Have you ever had a sweet deal under contract to buy, only to have the seller suddenly decide for whatever reason not play ball with you anymore?

What can you do?!

At first, you're their new best friend…

They ‘see the light', and they're more than happy to let you relieve them of their distressed property/situation for the reasonable price & terms you proposed and they warmly agreed to.

You're heroically saving them from the ‘bad house' situation they've somehow found themselves in.

Then, things suddenly go sideways…

A few days later, they suddenly want out and for no good reason.

- Maybe someone else came in behind you and made a slightly higher offer than yours. It happens – often shysters or noobs who don't know their numbers and just want a deal but can't really do it.

- Maybe they decide afterward that your car looked a little too nice, and you can probably do better than the contract price/terms they already agreed to.

- Or, maybe they just don't like the way your hair looks or your politics on Facebook or that weird southern/northern accent you've got suddenly turns them off.

Whatever the reason, things can suddenly get weird and go sideways. It doesn't happen often, but when a seller gets squirrelly and tries to cancel you for no good reason, what's an investor gonna do?!

Enter: The Affidavit of Equitable Interest ⇊

For the record, let me be clear…

I'm NOT into always holding sellers ‘hostage' to our agreements.

Life or circumstances really change sometimes. And when they do, maybe things are worth reconsidering sometimes.

If they've got a legit reason for having second thoughts, and are willing to have a thoughtful conversation with me to talk about them, then I'm always willing to listen, understand, and even back politely out of the contract we both previously agreed to.

Sure, I'm sad for a minute about the deal lost, but I understand.

But ya know, sometimes people just get WEIRD.

And for those now-and-then times when a seller suddenly gets squirrelly on you, and tries to cancel you for no good reason…

Well, that's exactly when you'll be super grateful that you've got this handy dandy “Affidavit of Equitable Interest” in your Awesome bag of tricks. ッ

And yes, I've got one for you. But first…

Here's a quick story about using it…

Video Transcription:

So you've got this sweet real estate deal under contract. Great payday on the other side of it… but the seller seems kind of squirrelly. You think maybe they might back out? What do you do? Can you do anything?

I think there is something than you can do. Let's talk about that.

So what the heck am I talking about?

I'm talking about a simple one page document called an Affidavit of Equitable Interest and you absolutely need it in your tool chest as a savvy real estate investor and I'll tell you why.

Let me tell you a story to explain it…

Over a decade ago I had a deal, a sweet wholesale deal under contract at 2215 Hunter Avenue. I remember it well and man I knew this was like in the early days of my wholesaling career. I was going to make a sweet $10,000 wholesaling this. I already had the buyer in mind. I knew I was going to collect that payday sooner than later.

I signed the contract with the seller. He was eager to sell it to me… but then a couple of days later he called me up and said, hey Mr. JP, I don't think… I'm thinking… maybe I'm not doing this deal with you. And I said, really? I took the time to sit with them and ask them questions and said, what's going on?

Come to find out. Another investor had come behind me and made him another offer with a few thousand dollars more. He was going to scalp the deal from me… is that the right term? Scalp the deal? Poach the deal from me. That's how you say that.

I was like, hey, I'm sorry. It's cool that somebody offered you more money but we have a deal. You sign the contract and I'm going to follow through and do the deal. We're just about to close here in just a few days.

And he said blah blah blah. I said no, I'm sorry but we have an agreement. He said no, I'm not going to do it. And that's when I said, Whoa, wait a minute, we have signed this contract and you have an obligation to follow the terms of the agreement that you signed and dated. He said well you can say that but I'm not going to do it.

That's when I pulled my hand out of my bag of tricks, proverbiably speaking, and whipped out the Affidavit of Equitable Interest. Now this is not a document that you should use on every single deal that you ever do. It would just be a big hassle if you did.

But when you have a deal like the one I just described where the seller decides for whatever reason he's just not going to do this deal with you. Maybe he doesn't like the way you look, maybe he's offended by your hair or something like that or he gets a better deal. Somebody comes behind you and tries to poach the deal from you. Whatever the reason. That ain't cool. And you can use the Affidavit of Equitable Interest to basically let the world know via public notice that you have an agreement to purchase the property from the homeowner.

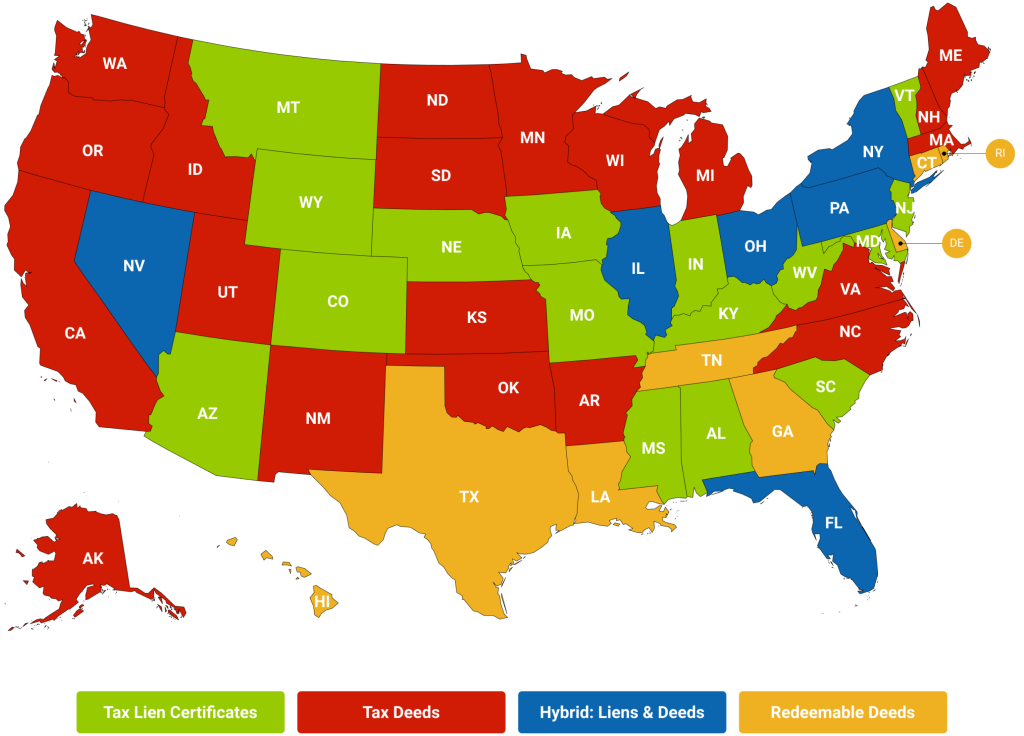

Now, the way that you let the world know is by recording this document. And that means, of course, in most counties, you're going to have to sign it in front of a notary public. Most banks have access to one right on hand… you can just walk into your local bank and say, hey, do you have a notary somebody with a notary public license… or whatever it's called certification? I guess… for $10 or $15, they'll notarize anything as long as it's formatted properly. They don't even have to understand it. That's typically how I do it.

So then you take that notarized document down to your county recorder or whatever it's called in your county, and you record it against the property.

What does that do?

Not only does it let the world know that you have an agreement to purchase this property, but it clouds the title.

So what that means is the guy that this gentleman was going to sell to instead of me couldn't get title insurance. He goes to a title company or a closing attorney to close the deal. They're going to do a title search, they're going to see this thing recorded against the property, and a title insurance company is not going to insure that.

So it basically holds clean title hostage. Now, this is something that if you're this kind of person, you could use this in a nefarious way. You could go and randomly cloud other people's title against their will. And I don't recommend I would never do that. If you do that, you're a jerk. You're an idiot. Don't do that. You're evil.

But when you use it to protect your equitable interest in a viable deal from a sketchy seller or somebody who decides they don't like the way you look and they're not going to do the deal with you, then that's a completely viable option. So I've not had to do this very often. There's only that one deal I can think of that it actually saved the deal. I've done a handful of other times when I thought maybe the seller's kind of looking at me sideways.

So again, it's just something you keep in your bag of tricks. You use it when it makes sense to use it, don't abuse it, obviously.

And the way that you're going to get it for free. This is the same one I use is if you're watching this video on our blog post, then just scroll on down below the video and you'll see simple instructions. And just follow the instructions and you can download it free of charge, no strings attached. You don't even have to opt in for it.

Basically, all I'm doing is trying to use it as an ethical bribe to get you to like us on Facebook. So scroll down on the blog post, give us a little like on Facebook because that's cool. Tells the algorithms and Facebook that we're nice and friendly and that people like us and then for the small cost of doing that, you get this free of charge and you can use it to your heart's content as long as you use it for good, not for bad, right? Don't go to the dark side.

If you're watching this on YouTube Then you obviously aren't on the blog. So just scroll down and look at the description of this video and you'll see right at the top you'll see a link to the blog post and just click the link in the description. It will take you right to the blog post and you just follow the same simple steps that you see there, okay?

So why am I doing this? Well, that's one of the things that we like to do at AwesomeREI.com is just share the tools and resources the contracts and the checklists and marketing pieces that have been time tested and proven for us, so that you can shorten your learning curve and sooner than later use them in your own real estate game to level up your bottom line. That's why we exist.

So you're welcome to swipe and deploy this and we have a handful of other things like this that we also give away. So on the blog post, you'll see links to some of the others that we've given away over the years… contracts and proven direct mail pieces that we've used and all that good stuff, okay?

Let me know what you think. Leave a comment below, please and I would love to hear from you. Is this something that you've used before? Maybe you have your own story to share about a seller that backed out on you that you wish you'd known about this? Maybe you've used something like this before.

There's also another document it's very similar function called the Memorandum of Agreement. So maybe you've used a memorandum of agreement or an affidavit of equitable interest. It's just separate fancy ways to say basically the same thing.

All right, so that's it. Thanks for tuning in and don't forget to be awesome today. JP out.

An Affidavit of WHAT?!

This handy dandy little one pager protects your interests as the buyer. It’s a form you will only need in certain cases, but one you should always keep on hand.

And yes, I'm giving you mine. So, now you will. ッ

First, let's just quickly clarify…

What the heck is “equitable interest”?

Equitable interest is what you (as the buyer) have ownership of during your contract period – from the time you both sign until you actually close.

It's more specifically defined by precise contract terms explicitly agreed to when a purchase & sale agreement is activated for any piece of real property.

And — Snapple Fun Fact — this “equitable interest” you now have is technically considered personal property, and it's what binds the seller to you and the terms of the contract. It's actually this “equitable interest” that you're selling when you wholesale a property via assignment.

That's not really the point. Just a nerdy sidebar I guess.

Here's the bottom line…

If you have a contract to purchase a property, and you’re not 100% sure the seller’s going to be loyal to the terms of your agreement, then you can protect your equitable interest by filing a document like this.

It basically gives public notice that you already have a signed agreement to purchase the property from the homeowner.

Doing so effectively “clouds” the property title, and makes it very difficult (if not impossible) for another buyer to get clear, insurable title. At least not without expense and hassle factor.

The “bad news” is that you have to get this doc notarized in most states in order to be “recordable” with your County.

But the “good news” is that you (as the buyer) are the only one who needs to sign it! Easy peasy.

So, it's not something you use all the time. But if you think you have a squirrely seller who may not make good on their end of the deal, a simple doc like this in your ‘bag of tricks' is a super useful tool you can deploy to protect your deal.

I’ve only ever done it twice, and one of those times it saved a deal.

Affidavit of Equitable Interest: Get Mine Now 🙂

Ready to just grab mine for your own Awesome bag of tricks?

Sweet, just remember: You might want to run it by a local Notary Public to make sure the notary verbiage is kosher for your area…

Here's how…

Step 1 ⤸

“Like” our Facebook page please?

Step 2 ⤸

Just leave a comment below sharing your honest feedback on the affidavit of equitable interest template I'm freely sharing with you. Whatever you think after hearing my thoughts behind it in the video above. Good, bad, and anywhere in between. Seriously.

Alternately, I’m also interested in hearing anything else (another resource or tool) that you’d like us to share in a future “Swipe & Deploy” like this. Do tell.

Step 3 ⤸

Then Chuck Norris will hand you over my template.

Totally serious. Just try it. 😀

Oh, and BTW…

In case you don’t know already, there’s an entire “Swipe & Deploy” goodies category over here—which we’re always adding to, and currently gives you everything from a transfer property letter, simple real estate contract to option agreements, a tasty letter of intent template, MLS keywords, a seller phone script & voicemail script— even some marketing goodies like one of our favorite motivated seller letters and seller postcards too.

This is an “Awesome” tool for investors to have to avoid being under cut and to protect their interest!!

Great information!! You never know when you might need it! Thanks for sharing.

Good idea to keep both parties honest

Awesome information thank you

Great product thanks JP

Such valuable information for the future.

This is handy document to have as I have seen this very thing happen to a friend of mine that was trying to get into wholesaling ad the deal got snatched right from up under her. This is needed document to have for the just in case situations, thanks for sharing your story JP!

What a valuable tool when used appropriately! Thank you for sharing!

Great contract

A good backup plan and a possible tool to work through resistance.

Is this something that both the buyer and seller must sign?

Had a deal almost fell through, need this document

Thanks for the information. Very good.

This is insanely valuable. Thanks.`

IM GLAD YOU LET PEOPLE KNOW NOT TO USE THIS FOR BAD REASONS

Sounds great

Totally AWESOME!

A great accountability tool for both parties. Thanks for sharing JP. You are a wonderful trainer.

Having worked as a residential maintenance man for the last 15 years

This is a very good document to have in your folder. But I would use it only if things look shady and not always against a party but for yourself

Awesome work.. well explained!

I am so glad that this document is available to me. I have had so many investors try to go behind my back and steal a deal from me.

Awesome

Good information

Great product thanks JP

This will certainly save me a lot of headaches. I’ve been trapped in a couple of situations like this already. Thanks so much guys.

This seems to be a good accountability tool for both parties thanks for sharing.

Having an Affidavit on file at the County is always a good idea. It can literally save your bacon, as I have experienced. And, it will be especially important as we navigate the choppy markets ahead of us. Thanks!

Thanks J.P. your always looking out for us investors! I couldn’t agree more that having Equitable Interest in the property you have under contract is a vital part of the agreement that should be done, for more reasons then not… Always appreciate the AwesomeREI team!!!

Great product to have in your wholesaling ‘toolbelt’

Love this strategy. I need this.

This would be a great resource.

That is a very good idea to have in your pocket

Sounds like a good tool to have in the toolbox.

I’m excited to use this in Texas. Also, I’m a notary and I do online transactions, if you need help.

Great gift! Will be using it in a small transaction I’m working on. Thanks for all you help.

Love the help you give us…especially on Saturdays. LOL This form will certainly help me in a small transaction I’m working on.

These are things that have never enter my mind, thank you for sharing.

Thank you for your generosity!

The affidavit should be used with a fire damaged home

Great information to have. I will consider using it on every contract.

The contract affidavit is is great when your dealing with fire damaged houses

I hope this will help thank you for the information

Brilliantly Simple and Simply Brilliant! Thanks!

always useful content. thanks

Yes, I have seen something like this before.

Thank you for providing such great tools!

Great piece of information. Thanks for sharing.

Will definitely start using this in my business. Thank you for offering!

awsome resources and good idea thanks

I am just so stoked to finally get to do the thing I Love. Thanks for all the great resources , posts, gameplans, and tools to bring my dreams to fruition.

I would use this every time.

I’ve always wanted to work in the Real Estate Industry and I never had time to take the course because I’m a single Mom and this has me so excited. Thank you again.

Great Idea!

Cool tool =)

Thanks for sharing. This will help to keep the deal sealed!

This is good to know and a great tool to have. Thanks for sharing!

Thank you for explaining equitable interest.

. I think I would use that with every offer or signed contract that I have. I like to keep things tight. The $10 or $15 for the Notary will save a lot

I did not know that I could do this in order to save a deal, great document to have in your arsenal. Thanks!

Thank you for this information. It will assist us in protecting our deals.

Nice weapon for good.

Another GREAT one – Thanks!!

This is about to save a deal headed the wrong direction. Thanks again

What a awesome Document to CYA! Every flipper/wholesaler should add this to their weapon arsenal. Thanks JP!

im very eager to put these teaching to use ,thx a million guys an GOD bless

Thanks so much! I definitely se this as a CYA document!!

Great tool, JP. Thank you for sharing.

Nice document

Excellent tool

i find it to be worth having?

Could have used this one for sure

Thank you so much for this info to keep our backs covered in every deal.

Just ordered the training, so far it’s very encouraging and I truly look forward to being awesome.

So happy to have the equitable interest document to hold Sellers accountable and on track!

great tool and exellent video

Thank you, I think that’s a great “incentive ” tool to encourage the seller to hold themselves accountable to the terms of the agreement. Thank you.

Interesting agreement

Very impressed with this content!

this site is awesome, wealth of information

I have heard of others mention this form and I did not have it nor would they share the form when I asked. Thanks, I really appreciate it…

Great protection and video

Great idea. I wonder if this Affidavit works for One Day Flips, which is what I’m about to do not wholesaling. Is there an affidavit for one-day flippers?

Hi Carl, all the paperwork you need for One Day Flip is the members area

on the Resources page.

very short and to the point. love the helpful info

JP you are the man !! haven’t had to use this but it is going to my toolbag

Thanks, JP! the Affidavit of Equitable Interest will be a valuable tool! Thanks for calling out the Dark Side.

Your video was short, sweet, and to the point.

I really like that you gave us no time to lose focus! The power of focus is AWESOME!

Great video you seem pretty cool. Looking forward to hearing more from you and your awesomeness

As a newbie, I am trying to acquire as much knowledge and best advise possible and I really really appreciate your authenticity and generosity with all the information provided.

Good stuff

An obstacle I can avoid in advance? Let’s keep this ball rolling!

Great idea to keep both parties honest and accountable.

Thank you for this resource. I’m very excited to get started. I look forward to hearing back from you.

Sounds like a good deal. Thanks for the advice. Hopefully, I won’t have ever to use it.

I want to keep everything up and up.

I am Impressed with the form.

Great information, great document!

Important document in this fast paced competitive market. Thank you for sharing.

Great content as usual. Every investor should have this in their toolbox. Thanks.

Excellent tool, helps keep everyone honest.

Thank you for your generosity. I appreciate the info.

This Affidavit is a must for those of us that are starting out in RE investing. Thank you

I’m new to RE so have never heard of this document but really good info, thanks

I would use this every time just to keep people honest, you never can see the snake in the grass.

I wish I knew about this a month ago. I lost 200k on a deal.

I wish I had this I lost 200k on a deal cause the lady backed out.

I am so Impressed with the Affidavit of Equitable Interest. I think I would use that with every offer or signed contract that I have. I like to keep things tight. The $10 or $15 for the Notary will save a lot of trouble and make you money.