Coronavirus and Real Estate Markets

This little piece of Awesome comes from the delightfully nerdy “mad scientist” mind of Ken Wade, a left-brained, analytical numbers geek like no other, who's also a world-class real estate dealmaker since the ‘80s. Oh, plus the beautiful mind behind MicroMarket A.I., the only system on planet earth that reliably deciphers & accurately predicts local real estate cycles — and spotlights “honey holes” in any local market, even down to the zip code & neighborhood level.

Boom.

Take it away, Ken…

So, everyone’s talking about the real estate market and how the cycle seems so crazy and unlike anything we’ve ever seen. True, but! Believe it or not, it actually follows with the same market cycle I’ve been tracking in real estate for almost 20 years now.

So, everyone’s talking about the real estate market and how the cycle seems so crazy and unlike anything we’ve ever seen. True, but! Believe it or not, it actually follows with the same market cycle I’ve been tracking in real estate for almost 20 years now.

In order to better understand today’s seemingly crazy real estate market cycle and trajectory, I’ve got a few principles below that you might find helpful in better understanding your target markets right now.

Because here’s the thing…

Everyone seems to have a hunch, a prediction, a wild-ass guess really… on where the real estate markets are heading.

They are all WRONG!

There will not be a single impact (one way or the other) affecting ALL local markets the same.

Just like the last time, some markets crashed, some flatlined and some appreciated.

For example, I’ve been warning about most California markets for a couple years. 9 of the 29 major California markets exited their Wealth Phase last year, well before COVID came along. Many more were likely to follow, even without a pandemic.

Other major markets all across the country were emerging from a decade-long slumber.

Every market is unique.

But make no mistake…

Coronavirus is a big deal for anyone involved in real estate.

Millions of property owners and investors in the wrong markets at the wrong time run a legitimate risk of getting wiped out (again).

That’s why they call it a ‘CYCLE’ — it’s a pattern that repeats over time.

- This time a virus will get credit for being the catalyst…

- Last time it was lax lending getting blamed…

- The time before that it was tax law changes…

There is ALWAYS some catalyst getting blamed, but the cycle goes much deeper than a single event.

The effects are not the same nationwide. Not even close.

I see a lot of chatter from so-called experts about the coming “opportunity.”

Why isn’t anyone talking about the coming RISKS?

Yeah, sure… almost every market presents some opportunity at some point in the future, but when?

Just like most markets present huge risks at some point in the future, but when?

Well, turns out, for the past 15 years, my Housing Alerts program has answered that question better than anyone or anything on Planet Earth.

And know this:

- We are committed to helping you during these trying times, and any time.

- Now is the time for clear-headed rational judgment based on facts and data.

- With all the uncertainty in the market, don’t make investment decisions blindfolded.

Speaking of which…

Here are those key principles I mentioned about real estate market cycles that will be very helpful for you to understand and keep in mind, as you gain more understanding of your own local target market and it’s crazy cycle.

Let me backup a second…

So, you’ve always heard real estate moves in cycles — but what does that mean?

And more importantly, how can you profit from it?

Well, as a general rule, prices for most things are stable (not cyclical) because changes in demand are quickly offset by adjusting supply.

For example, if you’re a widget manufacturer and more people want widgets, you (and your competitors) simply produce more widgets, right? And if demand falls, you cut back on production (supply).

Prices don’t cycle up or down because supply is in equilibrium with demand.

But, the opposite is true with real estate.

- With real estate supply is fixed.

- It can’t just be picked up and moved to areas of greater demand.

- Residential and commercial buildings (i.e., supply) tend to have a decades-long shelf life.

- Adding significant new supply takes a heck-of-a-lot of time and a lot of money, to say the least.

- And real estate is illiquid with high transaction costs.

In short, you can’t increase or decrease the ‘supply’ of homes or buildings in response to changes in the market’s demand.

When demand falls, prices go down… because that’s the only variable left in the supply-demand-price equation.

But when demand increases, prices go up.

So, a slow-moving chain reaction gets started: Builders typically s-l-o-w-l-y react to changes in demand by increasing (or decreasing) production. It takes years for the effects to have an impact on supply… and a new real estate cycle is born!

Small changes in demand have a big effect on price. And like I said, it takes many years to reach a balance.

But! Because builders have long lead times, they’re (always) late to cut production at market tops and late to ramp up production at bottoms. So, about the time when excess inventory has been absorbed (in any particular local market), builders have cut back so much they can’t react to the inevitable increase in demand.

And with that, the cycle reverses.

These cycles continue over and over in perpetuity.

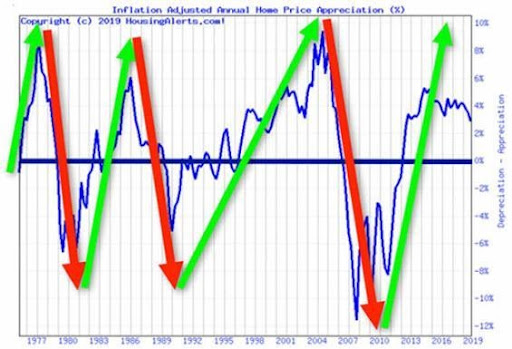

U.S. Overall Home Price Appreciation Cycles

From 1976 – 2020

That U.S. chart shows the past 3 cycles very clearly. You can see how cycles build for many years, and then sharply reverse direction.

Real estate demand can change very quickly.

Demand for real estate over the short and intermediate-term is driven primarily by market psychology, NOT by interest rates, employment, population, income or any of the other ‘fundamental’ factors.

What’s more, it doesn’t take much to trigger a reversal in market psychology. When it happens, there’s a mad rush for the exit doors. Because real estate is so illiquid, most investors simply can’t get out in time and the problem snowballs…

- Excess ‘For Sale’ inventories pile-up

- Prices crash

- Market psychology turns from greed to fear and builds on itself

- Buyers disappear

- Underwater property owners are now trapped and forced to ‘ride it out’

- The cycle intensifies from BOTH the demand and the supply side.

So…

For those and other reasons, real estate is, and will always be, very cyclical. Fortunately, if you have the right tools, these cycles are easy to see and profit from.

Back to the chart above — it covers the overall average for the entire U.S. Of course, you can only invest in local real estate markets, not in an average of all markets.

That’s where it gets interesting, and profitable…

See, local real estate cycles don’t look anything at all like the U.S. average.

While some local markets may be crashing, others may be emerging, or flatlining… local cycles are much more volatile and extreme.

About 2/3 of the markets in the U.S. consistently display high momentum on the appreciation and decline phases. These are the markets where generational wealth is made.

And the remaining 1/3 of all U.S. markets are either in long-term secular downtrends, emerging out of downtrends, or in long-term equilibrium (aka flat markets). These markets are not ideal for fast wealth creation and preservation. Transactional income strategies can be used to ‘scalp’ profits.

So what should your bottom line takeaways be?

- Supply and demand works very differently in real estate vs other things

- Understanding what this means gives you a big advantage in your REI game

- Real estate demand can change very quickly based primarily on market psychology, which most people don’t consider much

- Like I said, there are no national REI markets, contrary to popular belief, there are only local markets — and each has its own unique fingerprints and pacing to is cycle

Well, hope that helps you better understand your own target market and how it’s shaping up in these interesting times.

BTW – I dive deep into these ideas about market psychology, tracking and cycles in my MicroMarket A.I. training I did with the terrific team right here at AwesomeREI.

Enjoy,

Ken

Good information