The McCashflow Code

Hey, Josh Belanger here with your first Weekly Cashflow Trigger alert!

Hey, Josh Belanger here with your first Weekly Cashflow Trigger alert!

Before we get started, I want to welcome you and all of our new members.

Today, we’re going to get started on a 52-week cash flow journey. I’m so excited.

Every Friday I’m going to be sending you a Weekly Cashflow Trigger alert just like this one.

Before we dig in, one quick housekeeping note for you…

Our first Q&A podcast will be next Tuesday at 4:00pm ET. We will be sending that podcast to you via email. As you have any questions as you go through the educational series or after reading this alert, submit them right here and I’ll be sure to address them during our podcast.

Also, if you’re brand-new to the service, don’t be overwhelmed by all of the info below. Especially if you’re still going through the educational series. Remember, this is a marathon not a sprint! You’re learning a skill for life here. But it’s a new language and you’ll need to give yourself time to learn. Don’t rush to use this information if you’re not ready… there is another one coming next week, and the week after that for 52 weeks. So focus on learning right now and gaining confidence.

With that said, let’s dive into our first alert…

This Cashflow Code Generates Cash From One of the Largest Commercial Real Estate Owners on Planet Earth

Our very first cashflow code alert is attached to a play most people consider the world’s most off-the-radar real estate company.

It’s NOT on my Mega Real Estate Company List that I sent you when you became a member of Weekly Cashflow Triggers.

That’s because it’s not technically a Real Estate Investment Trust (REIT).

And even though it owns more than $30 billion worth of commercial real estate holdings…

And makes most of its money from real estate…

And even though almost everyone on earth has interacted with this company’s real estate…

Most people do NOT think of it as a real estate company…

For decades, this secret real estate company stayed hidden out of sight, disguised as something altogether different.

And then, in 2016, a movie was made revealing this company to really be a real estate company.

And today, we’re going to use this very specific cashflow code attached to the company to generate instant cashflow:

MCD221118P00230000

Intrigued?

Here’s what I’m going to cover for you:

- The fundamental story: Why I love this cashflow code this week (as opposed to some other opportunity)…

- How the Transaction Works: You’ll see how to actually use this trade to generate cashflow. You’ll see the steps involved… and I’ll show you a screencast showing how to place this trade in your account. That’s because a lot of people get intimidated by this process on their own. But seeing it outlined simply makes it easier to learn.

- Ongoing Support: If you’re confused by ANYTHING below, simply submit a question here an I’ll do my best to cover it in our upcoming Q&A podcast that we’ll email you on Tuesday around 4:00pmET. Remember, this is a learning process. So don’t be hasty. Learn each week and write down your questions. Then listen to those podcasts to learn even more about what I’m showing you here.

Let’s dive in…

The McCashflow Code

The real estate company I’m going to show you how to generate instant cash flow from today is McDonalds, the stock ticker symbol is MCD.

“What, Josh??? McDonald’s?? The burger joint?”

Yes.

We’re ordering a McCashflow to go… super-sized.

Most don't realize, but McDonald's (MCD) is not a burger & fries fast-food chain; it is one of the world's best real estate companies and portfolios.

Over those seven decades, McDonald's (MCD) built up a rock solid real estate portfolio.

Over those seven decades, McDonald's (MCD) built up a rock solid real estate portfolio.

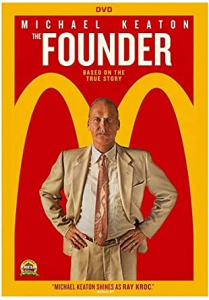

Until 2016, when the Michael Keaton movie, The Founder came out… a lot of people didn’t realize this.

But the movie shares an iconic scene at the very start of McDonalds expansion, when then McDonald’s CFO, Harry J. Sonneborn, once said, “we are not technically in the food business. We are in the real estate business.”

Since then, they've built a massive real estate portfolio that we’re going to use to generate instant cashflow today.

In the 2008 recession, McDonald's (MCD) used this opportunity to go on a buying spree adding more of the land and buildings where it operated to its portfolio.

Today, McDonalds owns real estate around the globe totaling $30 billion of real estate. McDonald’s (MCD) real business is acting as the landlord of its franchisees.

And we know landlords collect monthly rent checks.

Here's some context on how massive of a real estate portfolio McDonald’s (MCD) has worldwide…

It's estimated to be over 39,000 locations, of which 15% are owned and operated by the McDonald’s (MCD).

The rest are franchisee-operated.

That means 33,000 franchised-owned locations; paying McDonald’s (MCD) monthly rent.

That's a lot of monthly cashflow!

In fact, McDonald’s (MCD) reported $2,670,653,693 of free cash flow per share to investors on its most recent earning release on July 26th.

Those locations approximately makeup 1.2 acres.

So next time you see those golden arches… think fast-cash from real estate… NOT fast food. Selling hamburgers is just a disguise.

During their July earnings call, McDonald’s (MCD) provided the company's outlook for the rest of 2022.

They expect to spend $1.1 billion to $1.2 billion toward opening more than 1,400 net new restaurants.

That means they are out shopping for real estate that will generate EVEN MORE cashflow.

Which is McDonald’s (MCD) business plan to increase income and land ownership.

The business plan is to buy land, and have a new McDonald’s open every 15 hours.

But McDonald’s (MCD) isn't only collecting cashflow from rent on real estate.

It has even more cashflow coming in than traditional real estate companies. It's also collecting cashflow from those franchise owners to use the “McDonald's ” name.

That fee McDonald's collects is around ( 8% ) per store.

When you look at McDonald's (MCD), it reminds me of a casino operator and they become the house.

That's because the company not only sets the ground rules and provides the layout for success.

But every franchise owner has to sell burgers!

That's because the company knows it’s the easiest way for its tenants to profit and pay it back.

Genius, the house always wins.

And that allows McDonald's (MCD) to be aggressive with opening stores on top of real estate all over the globe.

Especially during economic downturns, like we are experiencing right now!

That's why McDonald's (MCD) is in the perfect position to thrive during uncertain times.

So McDonald's collects cashflow from those 33,000 franchise owners in two forms; rent and franchise fees.

Okay, so recap… McDonald's is really a real estate company… AND… it’s a cashflow machine!

Now, you’re probably thinking… “That’s good for them, Josh, but how do WE make cashflow?”

Good question! The answer is… we use cash flow codes to tap into that cashflow right now.

Before we get into using that cashflow code, though, I want to make sure you understand why this opportunity and right now.

As I mentioned, McDonald's (MCD) released its most recent quarterly results on July 26th.

If you're not sure that means, every publicly traded company is required to report previous earnings every quarter.

After the release, there's a conference call about those earnings, in which Wall Street analysts are able to ask the executive team questions.

In the most recent earnings report, McDonald's (MCD) reported a fourth-quarter net income of $1.64 billion.

That number was lower than Wall Street's expectations because higher costs weighed on its profits. Those higher costs include wage hikes to attract and keep workers. Also, certain ingredients for menu items are becoming more expensive.

Ultimately, while that’s tough news in the short-term this is good news for shareholders because these are short-term effects.

Meanwhile same-store sales in McDonald’s US locations rose 7.5%, topping estimates of 6.9%. That’s great.

And on a two-year basis, U.S. same-store sales climbed 13.4%. That’s really great.

In other words, the franchise owners are seeing sales increase, which helps offset some of those rising costs.

And during a recession, more Americans will look for cheaper food options which benefits McDonald's (MCD).

This is all wind to McDonald’s sails and provides us with an awesome instant cashflow opportunity off of a bulletproof business that sits on top of a A+ cash flowing real estate portfolio.

Which brings me back to the “McCasfhlow Code”

First, here’s this week's cashflow code we’re going to use: MCD221118P00230000.

At last glance, this cashflow code is trading between $2.16-$2.24 per contract.

So that means for every one contract sold I’m going to collect between $216 and $224 (a contract controls 100 shares, so, 100 x $2.16 or $2.24 = $216- $224. If you sell more than one contract, the cashflow you’d generate would go up.

How? Well, this cashflow code identifies the November 20, 2022 $230 McDonald’s put option that we’re selling for cash. (Module 3 of the quick start series specifically covers options pricing and how to conduct these transactions if you need a refresher.)

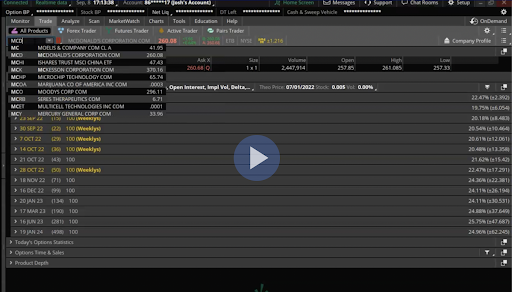

Here’s a screencast of exactly how it looks being found and executed in my own brokerage account:

(Image opens in new tab. Click to play screencast)

Here are the instructions written out…

Action-to-Take: Sell-to-open McDonald’s Corp (MCD) November 20, 2022, $230 put.

Here’s what I do while in a brokerage account if you’re not just copy and pasting the cashflow code. (Remember, depending on what brokerage platform you’re using, it might look different than my video. But these instructions should help.)

Step 1: I type in the ticker symbol MCD.

Step 2: I open the options chain for the November 18, 2022 expiration cycle.

Step 3: I locate the $230 “PUT” strike, which is located in the November 18, 2022 expiration cycle

Step 5: I double-checked the ticker symbol, expiration, strike and options contract type or what I call the “cash flow code” (MCD221118P00230000)

Step 6: I click on the “BID” price to open the order entry menu. (The bid price will be the lower price than ask price) The order entry MUST say “SELL” & “SINGLE”

Step 7: I select how many contracts to sell-to-open (remember from the quick-start series, this strategy is to “selling-to-open” or “STO… not buying.)

Step 8: I enter my price at $2.20, since prices are trading $2.16 and $2.24… $2.20 is middle of the market and will likely get filled at that price. So that’s why I chose that.

Step 9: Click “confirm & send” to review the order. This is where I double check again to make sure that it matches the exact cashflow code, quantity, buying power effect and that I’m selling-to-open.

Step 10: Then I press “send”

Remember, it’s best to use your paper trading account for this starting out. After you’ve done it successfully in your paper trading account, if you feel confident enough, then you can replicate it in a real money account.

Now, this instant cashflow transaction in a margin account would've meant that the broker would have set aside $2,300 in buying power for every put contract we sold. (Here’s the math: $230 share price x 100 shares in a contract = $23,000 * 10% margin = $2,300) I discuss margin accounts in detail in Module 2 of the quick start series.)

You don’t have to use margin, but if you do that’s important to understand and ask questions about.

This margin calculation is based on the broker's margin schedule, which is determined by the current expected range. This requirement could increase, which is why you’d want to have a cushion of cash in your account if you use margin on these trades. That helps you make sure you don’t get into trouble.

Now if we wanted to use a cash-secured approach (cash-secured put-selling is also covered with JP in Module 2!) on this transaction, we would’ve used a cash account.

In that case, the broker would set aside $22,790.50 for every put sold.

This cash set aside is to make sure that if the MCD’s started dropping below the strike price by expiration, I would be able to take on the risk of buying back the stock instead of keeping my cashflow.

Let’s Play Out a Few Scenarios…

Ok, so, here’s how I am going to manage this cash flow position.

Best case: I’m going to be looking to buy-to-close the McDonald’s Corp (MCD) November 20, 2022, $230 put at a 50% profit or at $1.10 per contract. The reason is because we want to manage to keep our profits and reduce our market exposure. The stock market moves and we want to dance with it, not stand still. Once we lock in our profit, we can redeploy for another opportunity with more cashflow opportunity.

So, best case scenario… generate and keep instant cashflow.

Then rinse and repeat…

Worst case: We don’t have to worry about McDonald’s Corp (MCD) going bankrupt, so the real risk is short-term market volatility that could push shares below our $227.90 break-even price (strike price – premium collected).

If that does happen in the short-term, I'll buy-to-close this position and roll it out for more time, while collecting more cash flow.

So in other words, we would just need a little time for the market to go in our favor. This will take a little more buying power and why want to keep 50% of our buying power available.

If that happens, we’ll cover it in a model portfolio update email as necessary.

I don’t know about you, but I would have considered those great odds with all the outcomes defined.

In other words, with this strategy, you know your risks.

Next Steps

Ok, so this first alert covered A LOT…

If you have any questions at all… I want you to submit them right here.

And I’ll do my best to cover as many questions you submit as possible during Tuesday’s Q&A podcast (that podcast will get sent to you on Tuesday around 4pm ET. via email). If I don’t get to them all, the podcasts are each week, so just keep tuning in and we’ll get to everything in due time.

Remember, this is a learning process. You’re going to get confident by wrestling with this information and asking questions. It’s like learning a new language. The rewards are huge, but if you’re taking the very first step, it can feel intimidating.

But don’t worry. I’m here. Just write down your questions and use our podcasts and the quick start series to learn.

Beyond what I’ve shared here, there’s a lot I can teach you about managing what happens, mitigating risks, etc.

So, I’ll be teaching you all about those situations as they arrive over the next 52 weeks.

Again, read this multiple times. Submit your questions right here.

Talk to you next week!

Josh Belanger