An LLC Doesn’t Make You Bulletproof & Tons More Tax and Entity Advice

Taxes. IRS. Audits…

Does the very sight of these words give you the creeps?

Trusts. Entities. S-Corps…

Are you breaking out into a cold sweat right now?

I get it. Details about taxes and entities can be confusing, complex, overwhelming and downright scary. Well, good thing we’re here to swoop in and make some sense of all of this in easy-to-understand, digestible info.

And by ‘we,’ I mean attorney, accountant and strategist John Hyre.

John is the guy with all the answers, friends… and, he should know it all, with 19 years of experience as a tax attorney and accountant, plus 14 years as a real estate investor. BAM! Expert in the house.

Not only is John a trusted advisor and friend of mine for over a decade now, but he’s assisted thousands of clients nationwide, from newbies to commercial operations. And, based on his extensive real-world audit and tax court experience, he wrote two fantastic investor resources: KISS Guide to Entities & Asset Protection and KISS Guide to Bookkeeping. (Do yourself a solid and check those out, pronto!)

John’s kicks off this video session with a top-notch presentation about all things taxes and how they relate to your investing business including non-entity asset protection as well as entity asset protection, audits and record-keeping.

As you’ll hear John explain, corporations, LLCs, trusts are important to protect yourself and your business, but most people (investors included) are looking at them with the wrong perspective. He says you should be spending more time on how to not get sued to begin with and how to win if you do!

John also tell us why he advises his clients to ‘Be British;’ helpful resources that provide tenant-landlord legal guides; the #1 reason why people sue in the first place; why a case settling doesn’t help you; and so much more…

More tax tidbits covered:

⇢ When you can’t be polite – do this instead

⇢ Why you need to watch out for slimy people who oversell complexity

⇢ In what situation an LLC makes sense vs. an S-Corp vs. a C-Corp

⇢ On which schedule your first few deals should be placed on your tax return

⇢ Which type of investor should have an S-Corp from day one

⇢ If you do this with a trust – you’re an idiot

⇢ Why trusts are for serious money

⇢ How to deal with audits and why we’re seeing fewer of them

⇢ If you don’t know the exact answer to an IRS question – you should say this

⇢ The #1 defense in an audit

⇢ Suggestions for what record-keeping tools to use and what not to use

We didn’t stop there…

Look, John is bringing to the table nearly 20 years of real-life tax experiences and stories from his career as an attorney, accountant and investor. This remarkably candid – and oftentimes hysterical – webinar is packed with info to set your mind at ease. Knowledge is power, people!

Plus, after John’s insightful presentation, we opened up the floor for a rapid-fire Q&A session.

Wanna know about the cheapest audit John ever did? Us too! Do you know how you should be saving your receipts? Yep, that’s in here too. Plus, why John flirted – yep, full-on, get your mojo groovin’ flirt on – with an IRS agent. Oh, and did I mention Salma Hayek is discussed? (Talk about mojo?!)

See, John freely admits that America has a screwed up tax system. But, he’s the guy to make sense of it for us. He tells it like it is so you know how to properly move forward in your investing business.

So get to it –check out this uber-informative webinar replay full of tax, entity and asset protection essentials.

Pro Tip:

Pro Tip:

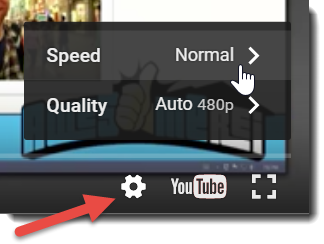

This is a full webinar, so if you're short on time or attention span, feel free to use the lower-right “gear” to speed it up and watch faster… Or slow it down to hear us sound drunk if you want. Cause that's always fun.

Video Transcription:

JP Moses: Alright, this is Awesome REI Live, a straightforward discussion on entities and asset protection essential for real estate investors with JP Moses and John Hyre. And I got to say that picture, I just need to apologize to everyone for using the name JPeezy to describe myself. That was 10 years ago when that picture was taken so I can, I can plead just a slight less level of maturity that I have now. Probably not really, but I just, I, it was 10 years ago, but that was John and I when we first met, uh, that was back when we brought you in as the speaker for the Memphis investor's group.

John Hyre: I remember that. I was a hippy look at all that hair. That's embarrassing.

JP Moses: I know, right? I know. May as well grow at an afro. So what's this about? Well, uh, for those of you who have not been a part of these with us, this is part of our monthly awesome Rei live webcast series. We do these on the first Monday of every month. We are actually live. Okay, we're going to answer your questions. We're going to sharpen your real estate investing acts. That is our goal tonight, and our discussion of course, entities, assets and keeping what's yours is yours. You deserve to keep it. We're going to talk about that. We're going to give you straight answers to your questions. Anything goes, but a quick word about your questions. Please don't type your questions into the question box yet. Okay. What I want you to do is you're going to have a lot of questions. You may have shown up with questions already. Um, you're going to think of questions as we go. Write them down on a, like a legal pad or something. Find something handy to write them down. Maybe type in a text pad note rather than filling the queue because we may get to your question before we actually open up for questions.

JP Moses: So, if we answered your question and we have to filter through and already answered questions, it’s kind of a pain. So write your questions down and then I will unleash the kraken and give you permission to go ahead and drop your questions in there. And then we'll just tackle as many of them as we can so we have a little bit of a structured discussion tonight and then we're going to get into your questions. I'll let you know when to drop them in there. Okay. Alright. So, uh, who are we in case you don't know? I'm JP Moses. Uh, I am a lifestyle driven, family focused, faith centric dude. I've been in real estate investing since 2000. I've been a wholesaler since 2002. I've done over 400 transactions. I had done a little bit of a lot of different types of investing, but by far most of my deals have been wholesale.

JP Moses: It's a business model that suits my personality. I like the velocity of it, uh, but we have a lot of other, lot of different types of investors here in our, in our community. We currently in our wholesaling operation, do about three to seven deals locally per month. And I am El President at AwesomeREI.com. John Hyre, uh, John is a brainy attorney. He has a clever accountant. He has a crafty strategist, all of which you're about to see a spotlight shown on here in just a moment. He has a. I have to make sure these numbers are still correct. Nineteen years of experience as a tax attorney and accountant, plus 14 years of firsthand experience as a real estate investor and has been a trusted advisor and friend of mine for 10 plus years now. Are those numbers still accurate or did I use some dated numbers there?

John Hyre: Last year I made it to 20.

JP Moses: You made it to 20. All right. All right. Um, I got to know. I always try to find some interesting pictures. Uh, depending on who I have here. And I've found that one on the bottom. On Your Facebook profile. See, you gotta tell me the story behind that.

JP Moses: What cruise or were you on here? What is this from?

John Hyre: You know I usually go on two a year. There's… Dyches Boddiford and Pete Fortunato do Captains of the Deal, and then Quincy Long and Walter Walford do one, they used to call it the IRA Fun Cruise, but now they call it Financial Friends Cruise. Lot of sharp people. A lot of great networking.

JP Moses: Absolutely. I love Walter, I love Dyches as well. I've never been on either one of those cruises, but I should, I just went on my first cruise.

John Hyre: You could have incriminating pictures of you…

JP Moses: That's right. That's right. You're obviously giving a talk there and, and then, uh, I guess showing off the Cozumel stop or whatever. Anyway, good times, uh, also, uh, John Hyre is, if you're not familiar, he, you need to know he is the author of the Real Estate Investors KISS Guide to Entities and Asset Protection, which actually, hold on a second.

John Hyre: Okay.

JP Moses: Looking there, looking here. Oh wait, that's the. Here it is. I have verifiable proof. I'm a product of your work.

John Hyre: You're still around to tell about it.

JP Moses: Still around. That's right. I'm the Asset Protection Guide and the KISS Guide to Bookkeeping. Both of these are literally on my bookshelf all the time and they're fantastic resources. Uh, I highly recommend them um if you are interested in checking them out. There's a couple of links there. Awesome.Rei.com/kiss assets, which I think is kind of clever and AwesomeRei.com/kissbookkeeping will take you directly, just kind of shortcut links to take you directly to where you can check those out. They're very reasonably priced as well. Uh, if that's something would serve you well right now. Um, what I'm not sure of is if you're training on self directed IRAs is actually currently online or not, so I don't have a link for that. Is there anything you want to tell us about that real quick, John?

John Hyre: I haven't seen it online. What I mainly do is push the work doc. Got one coming up in Tampa at the end of the month? Usually two days intensive, 7.99. I go at 3.50 an hour. So you get me for 14 hours instead of two hours and 20 minutes. We'd have really good feedback on it. I've done three of them so far. We usually partner up with a custodian. In this case it will be adempas down in Tampa. I'm flying back from South America just to do it. And I had, just to give one example of a general tax counsel of one of the custodians said it was the best analysis prohibited transaction he ever saw. So we get into a lot of back and forth, a lot of scenarios. First day is kind of rules. What can you do, what can't you do. Second day is just throw the meat on the table and see what sticks, deal structuring, deal, unstructuring, that kind of thing. So we've recorded the workshops. The first one we called the IRA meets the NRA because we did it at a gun range, shooting after work. So we did record one for those who can't make the workshops and they include the, the manual for the class itself, but live, we really encourage people to give it a shot.

JP Moses: The IRA meets the NRA. I like that. So, if you guys need, uh, some in depth learning on asset protection entities, bookkeeping for real estate investors or leveraging and wielding self-directed IRA's as an investment tool, I highly recommend John's material. And his direct website is IRA lawyer.com. Alright. So having said that, uh, just want to remind you guys of our core values here at AwesomeREI.com. These are important to us. They're important to reinforce a, this is what makes us who we are. And these are pulled directly off of the website. We have them on awesomeRei.com along with a lot of other things that mean a lot to us and that, uh, that reflect our, our values and what we'd like to represent. So I just want to put those in front of you guys one more time so that you're aware of them as Patrick Riddle, a partner in crime with Awesome REI. He's not here with us tonight, but that is a reminder to always be awesome. And before we turn into our main conversation tonight, a quote from Nelson Rockefeller, the secret to success is to own nothing but control everything. Interested to hear what you think about that, John.

John Hyre: Yeah, I mean, here's my issue. I've heard so many people use it and some of them were full of it, that it kind of jaded a little bit for me personally. We'll talk about that. The people who were into trust, you've got to have trust, trust the gray, quote that a lot. And so they've kind of spoiled it for me, you know? So I, I guess I agree with it to a point, but you know, I'll keep cranking.

JP Moses: It's like, like many good things that have been soiled along the way. All right, so, uh, this is where we turn to you, John. I'm turning over to you. I'm going to do my best to click through the slides. If I don't click through the slide at the where you're supposed to be let me know, just, you know, point of things.

John Hyre: Start making the monkey noises.

JP Moses: Yeah, there you go. There you go.

John Hyre: Perfect. You know what it sounds like. So, you know, if you hear that click, click, click. All right, let's go to the next one.

John Hyre: Uh, go ahead and click all the bullet points on. One of these guys that does them one at a time. Yeah. This is my background. I'm an attorney, I'm an accountant, I'm an investor. Most of my investing is in low income type properties. I'm actually inspecting one tomorrow for my 401k. The wholesale deal. A pretty good one. Um, I'm not used to seeing them anymore. That's good. Got a little lucky and I cherry pick the good ones. This one goes to the 401k. It's $15,000. The wholesaler is getting a 10. I'm giving them 15. It's a three bedroom. No, it was a four bedroom in a low income area, but not a war zone. It's already got a tenant. She's been in there for 12 years, so here's the upside and the downside. 15 grand. The upside is the rent is 620.00. She's been there 12 years.

John Hyre: The downside is when she moves, it needs a lot of rehabs. We want to keep her in there and probably get a life insurance policy. I'm going to meet her. The last thing I'll do after I do all the due diligence, tomorrow's termite inspection. This is our used to give them a property and look it over in general. Last thing I'll do before we close on the deal is talk to her and make sure she's good to go because it's key for me. If she stays in there three years, the estimated rehab expenses will be covered by all that. So after that she can move out and I'm good with it, but I like the deal enough I'm going to stick it in the 401K. So I do invest in, it makes a difference in how I look at taxes after protection, etc., because I do it for real and I know what you go through.

John Hyre: Um, I do have clients nationwide. We use the Internet, we use phone, we use email. Anybody who's interested, I'm on this call because I'm a greedy capitalist pig and I am out looking for business. So, and finally I do a lot of work with broad deals. People come to me when the normal accountant come, normal lawyer because he doesn't even understand what you're talking about. It was, you know, lease options subject to his assignments. Discounted note purchases, ABC closings, you name it. I've seen almost everything. And if you bring something up that's new, A, that would be very surprising to me. And B, I usually can dissect it and figure it out. So we see a lot of that stuff when it doesn't click on.

John Hyre: Yeah, I'm bringing all those puppies up. Here's a key. I've done a lot of audit work and a lot of tax court work and in particular I've done work with real estate but also IRA's, very, very few people. In fact, I still haven't met one. I keep looking. I still haven't met a fellow attorney or accountant who has dealt with a self-directed IRA audit or gone tax port or done it more than once or one more than once and I've done all of that so I have experienced upfront with what the IRS does, how they work, and we do represent people nationwide. I can represent you in an audit from a distance if you got IRS collection issues, I can represent from a distance and if you ever need to go to tax court, it's a circuit court so we would have the hearing in Columbus. That way you don't pay me to go anywhere. Plus, I know the local lawyers and get along with the local IRS lawyers and get along with them fairly well. So just a few things to think about, but enough about me. Next slide.

JP Moses: Forgot that.

John Hyre: All right. Let's start with asset protection. I started with nonentity asset protection and the reason I do this, most investors spend about 90 percent of their assets protection thinking time, so I don't know how much time do you allocate to asset protection, but whatever that time is about, 90 percent of it is corporations, LLCs, and trusts. You spend very little time learning how to not need those things. I should say it's not not need them, but hopefully not have to use them. It's kind of like spending a lot of time on term life insurance and not looking before you crossed the street and playing Russian roulette at random. Kind of makes it more likely you're going to need the life insurance if the wrong focus. I'm not saying that corporations or LLCs or trust are not important, I'm just saying put things in perspective. Spend more time on out of not get sued to begin with, out of when if you do get sued. Is this better If I take it off speaker, I hear a little bit of rebound.

JP Moses: Give it a shot. Yeah, probably. Probably be fine.

John Hyre: All right, so let's go be within up to my head. Does it sound better?

JP Moses: Sounds the same. Actually,

John Hyre: Alright, then we're just going to take away the dopey look. Back on speaker. Wait, wait, wait, wait for it.

John Hyre: Alright, very good. So, guys, I'm not saying LLCs, corporations across, they're not important, but it's all you guys tend to focus on. Let's talk about a few things to do so that hopefully you don't need to use the LLC. I want you to have it. I want it to be like life insurance. I want you to have it. I want you to not need it. So the first rule, most people sue because they're mad. There was a book written by Malcolm Gladwell called Blink and he taught them there about how litigators are always upset when somebody comes in and says, I want to sue my doctor. Why? I hate them? Well, that's not illegal. Well, then sometimes somebody comes in and the lawyer says, you've got a great case. We can sue this guy. We can tear them apart. We're going to make millions. And they say, I don't want to sue them. Why not? I like them. So be the guy that the tenants like as much as possible or the people you sell to, or the people you deal with. Now I understand there are some people you can't please, no matter what you do, but if you can avoid upsetting people needlessly, then do so. This is why I say be British, say unpleasant things in a pleasant manner. Uh, Winston Churchill has this quote attributed to him. When you have to kill a man, it cost nothing to be polite, which sounds really British. Hey, oh sorry.

John Hyre: I mean, just be polite and pleasant about things. You can say unpleasant things and a decent civilized, nice way. When you can't do that back off, have someone else talk or take a walk around the block. Don't say anything. The bottom line. Don't upset people without a need to do so. No one causes liability. Take some time and learn why the landlord, why do flippers and why do rehabbers get sued. When is the attack is successful? What could someone have done to protect themselves? Let me give you some study guides pretty cheaply available to that point. If you go to a Nolo.com, n o, l o Nolo, every landlords legal guide and every landlord protection guide have a lot of the asset protection type things. I give an example. In Ohio, if you don't shovel your drive as a landlord, so you leave it icy and full of snow, you can't be held liable because there's so much snow and ice in Ohio.

John Hyre: People are assumed to know that's a danger and they've got to be careful, but if you shovel once, you clean up a walkway once, the courts say the way that people can now rely on you to permanently keep the walkway clean. So good deed goes unpunished. It's important to know things like that. Where do you find that? Go to the West publishing west as in not east. West publishing is a legal publishing company and see if they have a landlord or tenant landlord legal guide for your state. Usually you'll have been written by a lawyer, it's a little bit of dry reading, but if you can make your way through it, you learn a lot. In Ohio, the guy that wrote it as very clearly pro tenant and he gives them every dirty trick on how to nail a landlord. That's valuable stuff, that's the otherside of the playbook. That's about a $200-$300 book that costs a bit, hold it between friends or the landlords you know. Last but not least, if you see a case, somebody cites a case that's been published, understand that only one in a thousand cases actually gets published, $999 thousand settle.

John Hyre: So by definition the ones that don't settle are the ones you want to know about and the ones that settle are the strange ones. Who knows how things settle because nothing's written down, right? If a case settles and it doesn't go all the way to trial, who knows what happened. The lawyers. The lawyers see these things that are not written. It is worth your time and again, pull your money. If you want to get a bunch of friends together, get a bunch of landlords together. Everybody comes up with 100 bucks and go talk to one of these lawyers, buy about two or three hours of their time and say, you know, why does stuff settled and which stuff settles for pennies on the dollar and which stuff do people end up paying a bunch for? How much of a difference to LLCs and trust really make? Do those have any impact on the settlement?

John Hyre: You'll be surprised with those guys have to tell you it's a good investment. If you could ever get one of those guys on here, maybe on the theory that they could get some business out of it, you can pick their brain a little bit. That's a really good guy to be able to talk to about that. I'll give you one and you know him. Um, out of Ohio. Jeff Watson for all of these. Uh, and I don't normally network with lawyers and accountants. I like entrepreneurs. People who create and build things. Most lawyers make me want to punch them. Watson's an exception. He's a good guy. Don't tell them I said that. This is recorded, isn't it?

John Hyre: Thank you. Thank you. Now get him on here and talk to him about what causes a settlement to be a good settlement versus a bad settlement and what does he see people getting sued for, what does he see win and what does he see them losing? That's invaluable information that very few people think about. Why? Because they think, I got an LLC, I got an LLC, I can do anything I want. I'm bulletproof. Bull, absolutely bull. Understand what's in your insurance policy, what's excluded, what's not covered? Some of it's explicit, some of it is subtle. For example, I own a mobile home park in Indiana and I know that bad dogs are not covered by my liability. Well, what's a bad dog? They've got a list of them state by state. Pitbulls are always on there, so we don't allow tenants with pit bulls because I want to cover that risk.

John Hyre: Now, the other way to cover that risk, because you can pay extra for a rider that'll cover it. Also, there are indirect items in there. Subtle things. For example, most liability policies do not cover intentional acts. Then we'll cover accidental actions. They will cover negligence, but they will not cover intentional actions. For example, if you or your contractor grabbed somebody's chest, somebody breasts, that's not an accident. That was intentional. Well, guess what? You're paying for that lawsuit, including the lawyer. It's good to know that it's good to try and cover yourself as much as you can on that. It makes you want to know people's history a little bit more. Who's working for you? What kinds of things do they tend to do intentionally that you would rather they not do for you? So these are all things that I find landlords and flippers and real estate investors in general, don't pay enough attention to.

John Hyre: They go straight to the LLC. Let's bear in mind the LLC only works if you get sued for a lot of money, right? If you get sued for five grand, the LLC makes no difference. One way or another, it's irrelevant, completely irrelevant. You get sued for a lot of money. You lose the insurance, doesn't cover you, and you fail to a good settlement. Okay? Now the LLC is relevant. Well, the idea is to not get there. Half the LLC, just like life insurance. I want you to have it. I just prefer you not use it. Make sense?

JP Moses: Makes sense. Before we continue, one quick thing. We've got a couple of comments from people saying that there's, there is lots of audio feedback. I can't hear it.

John Hyre: I can hear me on your, on your, uh, feedback. In other words. I hear me when I speak and then I hear me again feeding back on you.

JP Moses: Do you have your speaker on, on your computer?

John Hyre: Uh, no. I remember we couldn't figure out the speaker.

JP Moses: All right. So, uh, I will mute myself when you're talking and if that clears it out, hopefully that'll do the trick. Erica. It probably will. Erica. If for some reason that doesn't do the trick, let me know, hop in here and let us know so we can get it fixed in real time. We want to make sure we have good, nice and clear as quick as we can. Okay. Alright. Thanks. I'm going on mute.

JP Moses: Nope.

John Hyre: Oh, rent the politician. That's important. You know, you guys, you investors are so cheap. You shoot yourselves in the foot by how cheap you are. There are a lot of local RIAs, a lot of local lobbyists at the state level that you can contribute to. You live in a semi free country which is rapidly becoming unfree. But you won't invest in freedom. You won't fight. You won't talk out in public. You won't give money to lobbyists. You won't fight laws that are bad for you. You deserve what happens to you. If you live in a free place that allows you to make money and you won't put some of that money in preserving the place that allows you to make the money to begin with, then you've got it coming. Problem is I don't, so stop being so damn cheap and start investing some in fighting.

John Hyre: Contribute to worthy causes. Contribute to think tanks. The fight, the good fight, and as much as I hate to say, it contributed to politicians and I understand the argument, I shouldn't have to, well, you know what? I shouldn't have to have a gun and I shouldn't have to worry about defending myself, but in this world there are bad people. I do have a gun and if you come in my house, you're going to get to know it. So in this world you do what it takes to preserve the good things. One of the good things that says free country or semi free country now that we live in fight, fight.

John Hyre: Next slide. Okay, so when it comes to entities a couple of thoughts. I despise Nevada and Utah. Why? Because in my practice it's kind of like why does a cop despise criminals? Because the cop has to clean up the mess. Let me tell you what in Nevada an Utah. Here's my idea. With tax planning and entities, there are a lot of rip off artists. A lot of slimy hucksters. They oversell complexity. They overcharge you for it. They tell you, shouldn't you be like the Rockefellers.

John Hyre: No, you shouldn't. Now when you've got $100,000,000, come talk to me and we'll set up a $100,000,000 asset protection structure, but if you don't have those kinds of assets, you shouldn't be setting up that kind of structure. It's all bs talk. Here's the basics. Nevada law does not apply in your state. 99 point nine percent of the time, maybe one out of a thousand times Nevada law will apply where you live. Otherwise you're paying fees to your state. Plus in Nevada plus to the promoter, it's bs. If somebody trips and falls and your LLC, I have a Nevada LLC, well bad news that was $5 will get you a cup of coffee because they're still going to follow the law of the state you're in. So here in Ohio, if you have a trip and fall inside of a rental, it's still going to be Ohio law, but Ohio judge doesn't care that you have a Nevada LLC.

John Hyre: Now, sometimes it's rare, but sometimes Nevada or Utah or whatever law applies, but it's usually irrelevant to you. Let me give you an example. You can have a derivative lawsuits and you have a Nevada entity. Nevada law will apply to the derivative lawsuit instead of say, Ohio law where I live, but what's a derivative lawsuit? That's when the owners of the company sued the management. Now, for most of you, that's the same people. So if you want to sue yourself, good news, you can do it under Nevada law instead of your home state law. Wow. So same idea, by the way, with Wyoming in Delaware, the sellers are less slimy there, but there's still no real advantage to you. If you have a lot of assets, if you're worth over a million net, maybe we'll talk about one Nevada entity or one Wyoming entity somewhere in the structure. If your worth less than a million dollars net, it's very unlikely that these entities are paying for themselves. It's very unlikely that what you put forth in terms of time, effort, and money is being repaid and protection or tax savings. So Nevada….

JP Moses: Just to clarify a Nevada and Utah entities which are often sold as the gold standard to investors that, you know, everybody should have one. And why wouldn't you? You're, you're saying that, uh, basically it's really only something that is helpful in select circumstances for very advanced high income earners and most everyday mom and pop investors. It's not only a basically worthless but overcomplicated and causes more problems than it potentially fixes.

John Hyre: Oh, you said it. Alright, LLCs now, it used to be a different speech a few years ago before LLCs became standard, but nowadays if you have rental properties or lease options, because most lease option properties behave like rentals. An LLC is all you need. It doesn't change your taxes. There's no tax advantage.

John Hyre: It does provide some extra asset protection. The only exception I've seen is with certain foreigners because we are seeing a lot of foreign money coming into the country and I do a fair amount of that work with. I'm doing working right now with Canadians and French for the moment, so I know some of the peculiarities that arise when you got foreigners invest in here. Sometimes the foreign jurisdiction, the good example would be Canada, taxes, LLCs and a very nasty way, so for them, different types of entities or appropriate, but for holding rentals, it's going to be LLCs and no, you don't buy one property per llc. I don't have the time to go into the details. Let me put it this way. Most of the time the judge won't enforce the rule if the LLC is too little property on it. Let's say you have 10 low income properties that cost you $30,000 each and somebody gets killed on one of the properties. Do you really think the judge is gonna say, Oh my God, you have an LLC and so this death only gets $30,000 because you covered yourself. That is not going to happen. That is about as likely as Selma Hayek showing up to my house and having my wife agree with it. Ain't gonna happen.

John Hyre: Let's remember it's, it's a limited liability company, not a no liability company and if you try to convert it into a no liability company with too much equity stripping, too many entities, the courts are just gonna look right through it as an abusive shelter. Plus you know what? You're never going to maintain it. You say you will. You promise you will. You won't. It's kinda like February first for all the people who promised to be in the gym, January first and the tumbleweed. You won't maintain the entity correctly. It's easy to set a bunch of them up, but to properly run them and take care of them as a whole other proposition and my consistent experience with real estate investors as they'd rather be out making deals and staying home, doing paperwork and so they don't get it done. What are s corps good for the really the only reason you use an s corp anymore is to reduce self employment or social security tax.

John Hyre: Now that's different from income tax. It's a whole different tax. Usually it applies in a flipping context such as when you have, when you were a dealer and when you're a dealer, you're a dealer, right? If you're out there doing 12 deals a month, you're a dealer. I don't care how many entities you have or what your Nevada huckster told you. If you're doing that kind of volume, you're a dealer and you're paying social security tax. That's a perfect example of what an s corporation makes sense. It won't eliminate social security tax, but it will normally reduce it. Finally, when do you use c corporations and of course these are broad generalizations, right? If you go out and act on this as if this were legal advice, which it's not, it's educational. If you pretend this legal advice act on it and it doesn't work, guess what? You don't get to sue me. You lose too cheap to get advice.

John Hyre: Big Corporations, what are they useful? They're useful mostly for bracket arbitrage. When we like to C corporations is when you're in a 40 percent bracket, so let's say you're in a high-income tax bracket, you're paying 40 percent, the first 50,000 five zero. The first $50,000 of income and a C corporation is taxed at 15 one, five percent, so that's a 25 percent difference. It's nice arbitrage. It's kind of like a watered-down IRA. You put some money in, as long as the money's in there, it pays less tax and there are restrictions on taking it out. That's how I was looking at a C corporation. It was a very watered down IRA. So If you're not in a high bracket, C corporation probably doesn't make sense for you. All of these other deductions that the Nevada people talk about that C corporations are entitled to are either teeny tiny and don't matter or really only apply in specialized circumstances.

John Hyre: I'll give you a great example. when you noticed the Nevada people selling c corporations and why they're wonderful, they'll put about 15 bullet points on the screen and there's always a bullet point that says it allows you to deduct up to $50,000 worth of term life insurance. Hm? $50,000 of term life. I for a million dollars of term life, pay less than a thousand dollars a year, so let's see. 50 grand is five percent of that. Five percent of a grand is 50 bucks. It'll save you 50 bucks a year. It was pointless that that's irrelevant. It's such a small number. If you care about if you're an idiot, they put it on there just to make the sales pitch look better. Trust the nice lawyer the lawyer wouldn't like you. See corporations with a few exceptions only makes sense when your in a high bracket and you're trying to arbitrage that bracket and get a lower bracket and we're going to get a ton of questions on this JP. This is always everybody's favorite slide. They go nuts on this one because everybody loves entities.

JP Moses: Sorry, I think I just muted and unmuted myself. Got a couple of quickies before we move on to the next slide if that's okay. So, one of the things that many people will know here is a is a fact, some people may not know that both LLCs and s corporations are known as flow through entities for taxation purposes so that you're not taxed income tax wise at the corporate level. You're taxed, it flows through and you're taxed on a. On a personal level that I say that it's kind of like a W2 that were derived at the end of the level, you smack them on your 1040 and you pay the tax on it. So it flows through on your 1040.

JP Moses: Excuse me. The c corp, you get taxed a couple of times, both at the corporate level and at the personal level on, on what you got paid. So, well, that's one of the things you'll hear people talk about is double taxation with c corps, but for LLCs and s corp's, um, am I correct that it basically in, in interpreting what you said, that the s corp would be in a general sense best suited for people who are flipping, whether it's wholesaling or rehabbing and the llc is better suited for keeping. Is that kind of a good?

John Hyre: And in general, that's true. There are exceptions. For example, when you're buying and selling properties in the beginning. So let's define flipping. I'm going to use flipping today to mean you buy the property, you take title to it, and then you sell it. Maybe you rehab and prehab, I don't know. So it's distinct from an assignment deal, right where you never take title in the situations where you take title. I would probably have a regular llc in the beginning. Here's why you're not a dealer yet. There's no social security tax. So what I would do is for the first few deals and there's no number, everyone always wants to formula a number. It's really gut feel. I've seen enough case law that when you give me a scenario, I can tell you which way it'll go, but there's not a hard and fast line. I can tell you this….

John Hyre: The first few deals anywhere from three to 12 deals depending. It should be put on schedule d as in dog and not schedule c as in cat of your personal tax return because you don't pay any social security tax at all, which is better than an S corp see an S corp will reduce the social security tax. But on the first few deals, if you're taking title, and I don't mean an abc closing where you take title for 10 minutes, I mean you really take title and have a little bit of a holding period, maybe a couple of weeks, maybe a month, maybe a little more. If you're rehabbing it. In those situations. I would not start off with an s corp instead. I would put things on schedule d as in dog. Now, once you've done enough deals that it's clearly going to be a dealer situation, then I would move towards the s corp, but in general, I think what you say is correct. Just remember there are always exceptions and if you're that exception and you didn't talk to someone because you were cheap, cheap, cheap.

JP Moses: What if you start off with half a dozen straight up assignment deals and then thereafter you're at about an 85 percent assignment, 15 percent simultaneous close wholesaler.

John Hyre: First of all assignments—the IRS is going to look at those as a service and social security tax applies right away. So you're assigning, I don't care if it's an option or a contract, they're functionally the same thing. That's going to be social security taxable. So I would have an s corp from day one. Now how much do you to make them the s corp to pay for itself? Probably 20 grand net after all your expenses and the thing is roughly break even. Anything beyond that and it'll pay for itself purely on tax savings. The asset protection at that point is free.

JP Moses: Okay, right. I don't want to hog the question time for myself, so I'm going to move on to the next slide. Then we'll get to questions here for everybody else here in just a moment. All right. Next slide is a go.

John Hyre: I put there, the Rockefeller’s use trusts, and I'm quoting a very well-known gurus to sell you on trusts as the Rockefeller’s trusts. You should use trusts. The Rockefeller’s. Sorry, If you are, I'd like you as a client, but you're not. It's just like with the Nevada empathy's, you got to pick a structure that's appropriate for your size, trusts or tools. A lot of people say, you know, John's very antitrust. That's not true. I'm anti stupid trusts. I'm anti trust or taught, but every tool has a purpose. As long as you understand the tool and the use of it. I get people who tell me all the time I was converted, the trusts and man, that's an appropriate verb. That's for those people. it's religion. You can't talk rationally with them about trusts because it's their deity and if you say something bad about their deity, they get upset.

John Hyre: Sometimes they self detonate it. It's ugly. You've got to be rational about it. Trusts are not really for asset protection when it comes to small dollars, right? If you want to set up a trust like the Kennedy’s, the Rockefeller’s have, you better be playing with some serious money. That's a very specific type of trust, very expensive, but it can be done if you're talking more along the lines of land trusts, so they help with privacy, but don't confuse privacy with asset protection. But wait, John, if you were a real lawyer, because I've had this told to me before, if you really understood the law, like the guy who took a seminar and is a better lawyer now than I am. Suddenly, if you really understood the law, you would know that plaintiff's lawyers search for assets before they sue and if you look poor, they don't sue you. There's a word that comes to mind and it kind of rhymes with bullshitting.

John Hyre: Yes, I've interviewed plaintiff's lawyers, none of them search assets before they sue. All of them assume you have insurance and most of the time they're right and they're going to get paid and if you don't have insurance, it's a pleasant surprise because now what happens when they sue you, they know that you have to pay your legal fees and that means they've got you in a nasty place. So I had one lawyer say if it's a very large commercial case, he might look for assets because we assumed as the policy won't be big enough to cover a very large commercial case. Other than that they don't even bother to search. So there's a relationship to asset protection, privacy, and a low profile can make it less likely that you get sued. So if you don't stand up in a bar and throw shot glasses at people and scream that you're the king kong, of the real estate investing, you're less likely to be sued.

John Hyre: It's true. So low profile can be a good thing and trusts can help with that. Depending on your state, they make it hard for lazy people. Let me make that clear. They make it hard for lazy people to know more about you. Which look, if you think that's a good thing in terms of just plain principal as in it's none of your business. What I do then maybe the trusts can make sense for you if you think it's going to save you from a lawsuit. Yeah, I wouldn't go so far. The vast majority of lawsuits because something did happen. For example, the client tripped on the floor, tripped on the stairs of the furnace, didn't work right. There was carbon monoxide. The house wasn't wired right at burned down right, and all of those cases, the trusts make no difference at all. None. And I would love to hear the arguments.

John Hyre: No, they can't sue me. No, they can't find me. No. I look poor that's a bunch of hooey. Now in the sense of if you've got reporters and know it all’s and busy bodies tend to keep them away and to the extent they're prone to sue, which I don't think they really are, but to the extent they're prone to sue or cause a lawsuit, especially the reporters. Okay, there's some value there. There is some value there. Give you an example. My Japanese client and a client who's a buddy of mine and he invested in low income property and he didn't do very well because in Japan, low income people evidently pay their bills and he thought they were the same here. Good luck with that. Anybody that's low income landlording, those differently, those people are repetitious thieves, man. They weren't there like locusts. They will eat all the organic material in your home, including the rubber gaskets on the fridge and stripped everything down to bare metal.

John Hyre: That's what they do. So my buddy, after awhile, understandably, really wanted some anonymity. He sold most of the properties he had won. He put it in the land trust. He asked me to be the trustee, which I don't normally do, but he's a buddy and a responsible person that won't create liability for me. So one time I get a call from a neighbor and it was just the classic feminine. Excuse me, your tenants very loud. What? Your tenants? Very loud. Uh, okay. Well I demand you did something about it. Um, What? Evict them? Why they're paying me? Well, they're disturbing me. You do sound disturbed. How about you call the cops? Well, I did call the police. Yeah. Well, what did they say? It's better. Wasn't very loud. I think you have your answer now. Well, I demand to speak to the owner. Or what you know.

John Hyre: What are you going to do? Write me a letter, sue. Go for it sparky, click so that, that preserve my client's privacy was I able to act as a buffer and he never had to deal with this moron. Sure, sure. I understand that in some circumstances, trusts attract attention. I've dealt with attorney general employees and with IRS people, so when they see a trust, they assume you're hiding something. I had one assistant attorney general who had five trust courses. I won't name the authors, but it's all people you'd heard of. Gurus had a stack of courses and she said, your clients using trusts, to hide things I know you're hiding something because these courses, I'll say that's what you use them for, and now I'm curious. Oh, well that's not a happy conversation. Now trusts are. Here's the cost of the trust. The real cost is most attorneys, title agents, insurance companies.

John Hyre: Are not familiar with them and there's a lot of time half on brain damage and expenses spent than finding someone or educating someone to use them in a correct manner. That's the real hidden costs. Either way, if you pull a trust out of a course and you just use the template and you don't have a lawyer advising you, you're an idiot. Just that plain, straight out, and by the way, most of you who are in the trusts use a. trust he pulled from a course. You were too cheap to find a lawyer or too impatient to find a lawyer who knew what he was doing and so you just went ahead and used it without knowing what you're doing and for nine out of 10, it's a disaster waiting to happen.

JP Moses: Being a local investor here in Memphis who was using trusts to take time to all the properties, but they didn't actually create any trust documents. Yeah. They're no longer in business,

John Hyre: So I think most of the people who sell trust and the real estate world, the trust doers, I think most of them are full of more fecal matter than a Christmas turkey. They're just appalling people. I do like Duchess Boddiford out of Atlanta. He's a very meticulous and honorable person. I like a lot what he does, and I think he does it right and if you do it the way he says to do it, you shouldn't be okay. And remember to have a local attorney trust law, unlike LLC law varies immensely from state to state, it varies immensely. And so you really got to have a local guy that knows what they're doing, but that costs money. So yeah, you want the privacy, their costs. What do you think?

JP Moses: Yeah, I think so. Yeah. I'm glad you mentioned Duchess. The only people I really personally ever recommend on the topic, on the topic of trust is Duchess and on really any of the topic that we're talking about would be Duchess a Jeff and you, uh, those, those are, that's kind of the, the trinity, if you will have a real estate investing asset protection Sherpa’s. So you've already mentioned them all yourself included.

John Hyre: Yep. It's a small bunch man. Do you want to go to the next slide or do you think we covered enough that we do those on the next call and take a bunch of q and a. Because I was going to talk about audits. I don't know how long you want to go. How many questions you got? I can't hear you. You're on mute.

JP Moses: I told everyone to hold off on the question so we don't have any in the queue yet. Um, let's, let's continue, but I'll go ahead and invite everyone who's dialed in with us to go ahead and begin submitting your questions in the webinar here. Just whatever questions you have, go ahead and start dropping them in and a, in just a minute here. We're going to start answering them. Okay. So let me go ahead John, you can go ahead and continue. Let's talk about audits and then we'll get to some q and a here in just a minute.

John Hyre: Part of keeping what is yours is knowing how to deal with an IRS audit. So here are some thoughts. I'm really good at audits. I love audits, I like to fight. I love scrambled, just to scrap with these people and so far for the last five years, knock on wood, I've only had one client cut a check to the IRS and with this particular client we told him whatever money they say to give them, you give them. He didn't file returns for 10 years. Oh, that's not good. Don't do that. That's the evasion. So we didn't. There were no criminal charges, thankfully. And he paid what he owed. It was very painful because they had them in a rough spot and he knew it. Um, a couple of thoughts. There are fewer audits now do the budget cuts within the IRS and that governmental incompetence. So there are fewer audits, um, partnership and llc audits should increase.

John Hyre: There was a law Congress passed back in the eighties called TEFRA that was designed to make partnership audits more accountable and harder. That's one of the reasons the IRS is not audited a lot of LLCs and partnerships because most LLCs are structured as partnerships. They've changed the law to make these audits a lot easier. Also, what we're seeing the IRS is compensating some by doing more correspondence audits. So you might get a letter that says, all right for your meals, entertainment and travel for the months of February and august of 2013 send us every single receipt. And if you don't have them, we're gonna cut. We're gonna disallow deductions through the whole year and if you're missing enough, we may expand the audit to other areas because we figured if we got money out of this issue, maybe there's more stuff for us to dig for. So that's a lot of work, right?

John Hyre: They send you a letter about this big and you spend a month coming up with receipts and everything else, so that's something we're seeing more of. It's not very pleasant. Most audit start with the limited scope. These top priority you have. well, let's start with the rules dealing with the IRS. Hey, never, never, never, never, never lie. Don't say anything that could be even wrong because they'll spin it to be a lie. If you don't remember something, if they ask you a question and you don't know the exact answer and I mean the exact answer you say, I'm going to go find out because if you give a wrong answer, sometimes they spin that into a lie and now you're dealing with an orange jumpsuit or maybe they threatened you with the orange jumpsuit to squeeze all the money out of you. That's how the system works, for those of you that voted for socialism, aka democrats, because it's the same damn thing, you've got to come and I don't feel sorry for you at all.

John Hyre: Now, for the descent people out there, sorry, it's the system. It's the nature of it. They have a lot of power and they use it. Don't ever lie to them because it puts you in their power. If you're not sure about an answer, you go get the right answer. Second, don't ever answer a question that wasn't asked you. Think very carefully about what was asked and you answered exactly the question, but even if you think the question is stupid or irrelevant, you answer only what they asked carefully. So most audit start with a limited scope and the object is to get through it there. For example, if they come in and say, and here's a very common way they start, they love to go after meals and entertainment and car mileage. Can you back up your car mileage? And if they get something out of you than the audit metastasizes, it spreads. So the object is really to bust your butt and support what you put on your tax return on the first hit and avoid the audit spreading. Now Tim, it's still spread. Yeah. But in general they don't go to the next bullet point or slide.

John Hyre: Okay. The cheapest audit I ever did set a record in 2015 for the cheapest one and the most expensive one? Not both of them. The cheapest one. I only billed about $1,300, which is, let's see, at that time it was 300 bucks an hour. So what's that come out? So a little more than four hours of my time. And the way It worked was we had an engineer, it was very detail oriented and meticulous. He's a signer, so he does. He has a W2 job by day and he assigns properties by night and he had a schedule c and they went after three of his different deductions. I forget what they were, but he. I spent about an hour and a half walking them through how to put the records together and he did exactly what I asked him to do. He had all of those receipts.

John Hyre: He had everything in order. It all added up. It was beautiful. It was about an hour and a half for that. He did most of the work and I just reviewed. I went into the IRS agent’s office and she did one of these, boom, puts it down and says, I think we're going to be good on this one. She could just tell he had it all together. We ended up spending another hour and 45 minutes flirting and talking about a few things and she was not hot. I didn't flirt with her because she was hot. I've only ever seen one hot IRS agent. This one, she was first of all the cat lady and you can tell because you walked in and her cubicle had tons of cat pictures. So right away you get a little nervous, right? You want to make sure there were witnesses and stuff so you don't disappear. And she's also a big fan of the local hockey team and you can tell the hockey guys because she had a picture of her hugging every guy on the team and you can tell they knew she was an IRS agent because she's kinda like. And they're kind of like, you could just tell. I mean, so we flirted for an hour and 45 minutes. Why? Because after she told you she's not going to hit your client and it only took 15 minutes. Are you going to make her mad?

John Hyre: Did I bill for the time? You better believe it. Was the client happy to pay for it because he paid the IRS zero and it was my cheapest audit ever? Yeah, he was happy. My most expensive um, audit. And it's really because it went to tax court. This was a self-directed IRA that I don't have time to get into huge detail, but it was a big audit. IRS started off by saying this guy owed almost a half million dollars when we got that number down to zero. And I only charged them 25 grand. And let me tell you how I made it 25 grand because here's the interesting thing, there was another lawyer on a very similar case with exactly the same auditor at the same time and the clients knew each other. So they were comparing lawyers and comparing notes. The other lawyer charged over a hundred grand and lost. I charge 25 and one and how did I do it?

John Hyre: Now? There could have been a little luck. I don't know what happened, but I did notice the other lawyer. First of all, he was not honest. Part of honesty is telling clients what they don't want to hear. You had a terrible case. I suggest you settle. That costs me money to tell you that I'm much better of if I say, you know, I think we can take them. It's not a hundred percent. So I'm going to cover my butt. It's not a 100 percent. We could lose, you know, don't blame me if we lose, I think we can take them. I see a lot of that. And it's bull. The first duty is blunt honesty, your case is horrible. I suggest we settled as fast as we can. Paying me is very unlikely to help you. When a lawyer tells you, don't give me money, you should listen to the lawyer.

John Hyre: Second delegation. This other lawyer insisted on doing $20 an hour work at $300 an hour. All the bookkeeping for the client. He did it saying it has to be done by a lawyer and just a certain way and people are so afraid. They believe that. Now I told my guy, look, I'll do it at 300 bucks an hour. Why don't you get a $20 and our bookkeeper and I'll review their work? That's an honest answer. I don't. I don't want to rip people off by using the fear they have to do work that I shouldn't be doing. I template a lot. I keep a lot of templates. I steal templates. I, I look up case law and then I ordered the transcripts and pull other people's memos and take the best parts out of him. I templates like a mad dog, but I also changed the templates.

John Hyre: I improve them constantly. I am the board. Resistance is Futile. You will be assimilated. I counterpunch. What does that mean? You know, it's different from a criminal case. This IRA case, I had hit about 50 deals, the IRA lawyer, the other lawyer charged to look at every deal in detail on the theory of I have to know what's in there, bob. I got to know to defend, you know, no actually I don't need to know. Right? This is not a criminal case in a criminal case. That's a legitimate argument and a criminal case. I have to know every detail. It's different in the tax case, I am going to give the IRS what they asked for as long as they're entitled to it. And I'm not gonna say anything about it until they make an attack. Because why would I look at the material until I know what they're gonna do with it because can I change anything?

John Hyre: Can I change the past? Can I change the paper trail? No. If you've got a bad case, they're going to know and I can't change that. If you've got a good case, my knowing ahead of time isn't going to change that. So, I wait for the IRS examined the materials, they asked for it, we give it to them unless it's something inappropriate. Once in a while I'll object to a request and say, no, we're not going to do that, and they'll say, well, we'll go to court. And I was like, okay, go ahead. They never do. You wait for them to make the attack and then you respond to what they say. It's much more efficient. The counter punch with the IRS than it is to just go and flailing and hammering. I blitz around problem IRS people. I've had agents who were just horrible to deal with and I intentionally upset them.

John Hyre: I just drive them nuts quickly. JP, you know I have a talent for this. I upset them in a nice polite way so they can't hold it against me so that the case, I'm quick. I usually tell the client, look, we got a bad agent. I can. Most lawyers would argue with them for 40 hours and run out the clock, and what I'm going to tell you is my read of this agent is they're irrational and will never going to get anything out of them. So instead of me billing a bunch, let's get this case over with. Understand they're going to say you owe a billion dollars. Just understand that. They're going to say that. That's okay. We're going to go to appeals. We're going to go to tax court, we're still going to do well, but not with this agent. Now, if you want me to fight, don't get me wrong.

John Hyre: I'm happy to find a 350.00 an hour of fight all day long and all night long and then so the next morning, but it doesn't always make sense. You've got to judge the people you're around. I profile on auditor's big time, big time. I love millennia’s. There aren't very many. The IRS is aging rapidly and the way their retirement system works and such, they haven't really been hiring, but I love it when I get a millennial, why they were even lazier than normal government employees. Oh, I love them. Plus they're easier to intimidate. They don't have the experience. So finally I put, you know, the Byzantines were amateurs. Um, there's a phrase in English language that when something insanely complex and convoluted you say, my god, that's byzantine well if the byzantine saw our tax system. They'd say you're making fun of us were going to say complex stuff that's American because nobody has a more screwed up tax system.

John Hyre: But bottom line is I represent clients in audits all over the country. You don't have to teach me about real estate. I understand real estate. I've done a lot of research already, so I usually know where we're at in a case very quickly and I can usually, I have to do some research but a lot less than a guy who doesn't get real estate. So if you know someone getting audited, I'm really good at it. I can do it anywhere in the country. I enjoy it. But part of keeping what's yours is knowing how to deal with the audits. And let me tell you the number one defense in an audit. Good records, good records. Go to the next slide. If you would, we'll get in the good records and then we'll. I think we'll do q and a. I don't think I have very many left.

John Hyre: AlrIght. I like QuickBooks. It needs to be customized for real estate. Yes. I do sell a very cheap course that teaches you how to do that. It needs to be customized for real estate, especially the chart of accounts. It's cheap. It's about a $200 program, sometimes less. I like QuickBooks pro, right? There are different versions of QuickBooks. I like pro. You can use it for about three years and then the functionality starts to degrade. You can't download things from the bank, for example, after three years, so I like QuickBooks pro. It's a lot easier than most people think. I do not like online QuickBooks online QuickBooks is very expensive because it's only one per company. Where normal QuickBooks is like normal excel or word. If I buy the program, excel, how many documents can I create? Thousands. If I buy one copy of QuickBooks not online, the regular QuickBooks, how many companies can I track and QuickBooks thousands you by QuickBooks online.

John Hyre: How many companies can you track? One, so it's way more expensive and it's clunky. It doesn't always work right, so I don't like it. Please scan your receipts. It's the number one way the IRS Nazi guys down. No, your credit card statement isn't good enough? No. Your bank statement isn't good enough. You need actual receipts. Just show a little bit of discipline for pete's sake. Stick them in an envelope. I mean a half the places in the universe will now email you receipts so there's the email to you put it in a folder. It's if you get them on paper, pay your kids to scan it, deduct the money you pay them, the money's still in the family and you got a tax deduction and the kids learned how to work, so that's great. Or use an app. If you don't want kids, they're too expensive.

John Hyre: So you get an app because the app doesn't wake you up at three in the morning. there are all sorts of apps that will take and download receipts and the pdf back it up in multiple locations, including to the cloud and write your notes on there. For example, you go to Wal-Mart write what was it for? Which properties was it for? If it's meals and entertainment, write who you were talking to, what the business connection was. It's so simple. It's not a hard thing to do. This is the number one way the IRS gets you guys. I'm telling you, if you're like that engineer, if you have good records, the audits tend to go a lot faster and you get a lot better result. Otherwise you end up paying someone like me and I can get you out of trouble, but not all of it. Keep good records. It's it's important and it's a weakness for real estate investors. You guys are so fixated on deals, you don't do the back office work. If you don't want to do with pay someone to do it, go do an extra deal and use the deal profit to pay someone to do it, to keep you out of trouble. Cause the nature of the world we live in now. You got to be accountable. What do we got? Anything else? Yeah, I don't remember what I did if I did more after this. That's it.

JP Moses: I would like to start off with the first question, which is relevant to what you just talked about and we do have a number of questions in queue here of really great questions. Let me remind you, this is the time to submit your questions. So I want you to just think about where you are in your real estate investing business right now, what kind of business you're trying to do and whatever your biggest, most burning questions are about entities, asset protection, avoiding the IRS audits or fighting, IRS audits, uh, anything that we've talked about. We've covered a lot of the essentials, uh, through John's presentation here, but anything else we haven't covered that you want to ask about now is the time to drop your question into the question box and we'll do our very best to get to it. My first question is, has to do with the record keeping receipts basically.

JP Moses: So I, I run an entirely paperless office. this is the room above the garage. You can see behind me, it is my office and I don't really want to keep paper in it anymore than I have to. So what I do is all of our company files are in the cloud. Uh, we keep them in Google drive and Google drive is a fantastic app on the phone. There's a question I'm getting to, by the way, a fantastic app on my phone. I use an android and what I can do is I can go into Google drive and I'll go into house guys, which is the name of our wholesaling company. Then I'll go under finances and then I'm going to receipts. Then I'll go under, you know, whatever month it happens to be or what first I'll go into the year, then I'll go into the month. And so for example, June of 2016, I'll have a folder called June 2016.

JP Moses: And uh, every receipt I get, like if I'm out at a restaurant having lunch with a partner, talking about a deal, right? Put it on the business, on the company credit card. I'm going to write on the receipt, um, lunch with James Allston regarding one, two, three main street. My first question is, is that sufficient? But before you answer that, then I will pull out my phone, click on the Google drive app, go to that folder and hit the plus sign and do a scan. It doesn't just take a picture, the picture becomes a pdf immediately that it saves it in that folder as a pdf version of the receipt. And then I crinkle up the receipt, throw it away and we'll have to deal with the paper. Uh, it's a, it sounds maybe cumbersome for people who aren't techie, but that's a super fast process for me and it keeps me clean of the paper. So what do you think about that?

John Hyre: That's beautiful.

JP Moses: Yes.

John Hyre: Well, you need to do.

JP Moses: Yeah. Is that the proper notation for that type of receipt as well?

John Hyre: Yeah, it'd be a touch more specific on, on the business, but otherwise, yeah, yeah. You make a sentence just, you know, we were discussing buying a property or we looked at a property. Well, we were gonna talk about financing or whatever. Yeah, you put who it is, what you talked about. Boom. Done.

JP Moses: Wonderful. Good. I feel better about it that I've been doing it for years, but. All right, so let's jump in. I've got a question here from Kurt. Kurt says, how many properties per llc and how do you act appropriately for them to be considered valid? I eat a separate business account and tin for each llc, ect.

John Hyre: All right. That's a big question. Would you like to spend a half hour?

JP Moses: No, let's, let's go with

John Hyre: Let me do a shortcut. How many properties? It depends. What state are you in? For example, if you're in Tennessee or Ohio, they're pretty cheap states. They're easy to deal with, so if you're in California, you pay 800 a year for llc. It depends on where you're at.

JP Moses: It will vary for people, but he just answered. He's in South Carolina

John Hyre: And I would say in general, and this is just a rule of thumb, right? I just made up the number. If I don't have 200 grand of equity, I don't have a second llc. Now, if you're paranoid, you might say 150 in equity and if you have $10 million in equity, you really want LLCs. No, you're going to change the number as you get bigger. I have 10 million in equity. I'd probably have 10 LLCs each with a million. Right. So it depends. It varies. Is this coming through? Okay, I just got a note. It says I have a slow connection, which means my kids are doing what I asked them not to do and downloading terabytes of information.

JP Moses: I'm getting you fine.

John Hyre: Okay, cool.

John Hyre: Um, so how many entities? I like if you don't have 200K in equity, you don't have all that much in the way of assets to protect. How's that?

JP Moses: It's more a factor of segmenting the number of properties. Um not based on a particular number of properties, but based on just trying to keep your equity protected in chunks.

John Hyre: And they'll be some natural segmentation. What I mean by that is let's say I have three partners, maybe I don't have 200 k in equity, I've got three partners and we each have an llc because that's how it's done, or maybe I have properties in Ohio and Indiana and my Indiana properties are in one llc and the Ohio ones are in another, so sometimes you get natural segmentation, but if it's all stuff you own, 100 percent of between you and your spouse, say in the United States, 200 k and equity, how do you maintain the entities? Really briefly, the number one way to blow an entity is commingling money. If you lend money from one company to another, the do to do from, I don't like that, I don't like it. When the company pays for your personal stuff, you should sign checks and contracts as your position.

John Hyre: In other words, John Hyre, manager, you should have a bank account for every company. You should have a set of books with an income statement and balance sheet. For every company you should have. You don't have to, but it looks better if you have an annual meeting. It's better if you have resolutions. What's a resolution when you do something exceptional and you define what's exceptional? For me, it's every time we buy a property or borrow money, it has to be a company resolution authorizing it, and that's a template form, so I'd say those are the main items. It's really not that much. Really treat it like a business. Make it look like a business, so when the judge looks at it, treat it like a business.

JP Moses: One of the other things I'll add to that too, I know from our previous conversations is that you recommend having one of these as well. Binder and what do you refer to it as a psychological propaganda. I believe I. It's essential keeping this is it rather than as much as I love to have a paperless office, I'd love to not have this sitting on my desk or sitting on my shelf, but you recommend that I have a paper version of my corporate records, all the resolutions, all the minutes and everything that are needed for an entity and not just have a digital so that it has some thud factor when and if you have to show it to anyone. Really. Is that.

John Hyre: Yup. fairly psychological, but it matters. I like it. The thud factor. Did I use that term in the book or did you make that up?

JP Moses: I don't, I probably, I'll take credit for it.

John Hyre: All right. That works.

JP Moses: I can't get this. Can't get it back. It's got too much thud factor. Okay. Next question. Is, uh, a still from Kurt. He's asked to you group your properties by risk or value. You kind of touched on this a little bit, but is there any, does that bring any clarifying? Um.

John Hyre: Depends on how much stuff you got. Yeah, I will absolutely grow up in. I consider low income properties risky because they're full of low income people with a low income mentality. Part of that low income mentality is they like the suit as my low income tenants. I got rights! Okay, great. Tell me all about it. so yeah, I would move, for example, low income rentals and high end stuff. I would keep them absolutely separate, but again, it depends on how many you got. Right? If I've only got one or two low income rentals and one higher end one, am I going to put that in separate LLCs? If I don't have a lot of equity, maybe, maybe not. Again, you've got to be practical. There's a hassle factor involved. You gotta ask yourself an honest question, are you gonna maintain it, right? All the stuff I said, that beautiful little book you showed us, are you going to do that? Most of you won't, and if you're not going to do it, don't bother with the other entities.

JP Moses: Scott Wood asks, should a LLC be used for master lease options?

John Hyre: Know it depends on what you mean by master lease options, right? People use these terms and they can mean different things to different people. I'm assuming he means sandwich lease options. You got one lease, you lease option from someone and then to someone else and you're keeping the income and then if the person ever exercises, you're making the profit on the spread. I assume that's what that means.

JP Moses: Let's assume that for the time being, yes.

John Hyre: Okay. That looks and acts like a rental, right? It produces rental income that you don't have depreciation because you don't own the property, but you've got rental income and there's sort of underlying financing. It's more in the nature of a lease instead of debt, so I would use an llc for it. Why? Because most lease options act like rentals and not like flips.

JP Moses: You'll like this one. I have a couple of people, a couple of different people asking what your opinion is on checkbook, LLCs for self-directed IRAs.

John Hyre: You know it's a great topic. It's off topic, but it's a great topic. I have very strong opinions on that that I can back up. Let me give it to you real simply and we could do a webinar on this one time, we did another one in a separate context, but we could do one for this group. A checkbook, LLCs or an LLC, 100 percent owned by an IRA and the idea is you are the manager of the llc and you have control over the money and you can write checks and other words. You don't need no stinking custodian. In that context I don't like them at all. Um, and agaIn, I'm talking to you. I'm the only person you know of that has been in an IRS audit on self-directed IRAs at all. I'm certainly the only person you know who's been In more than one of those and gone the tax court and one, if anyone on this call has heard of someone who's done it besides me, I'm all ears.

John Hyre: I want to meet that person and trade notes within a month dead serious because I liked to learn. Let me tell you, there is a that we're switching gears. That's why I'm taking a second to think on IRAs. The code says you cannot provide a service to your IRA. So let me ask you three questions. First of all, let me clarify. When the code says you cannot provide a service to your IRA, it doesn't say you can provide a service if it's free. It didn't say if you pay yourself, it's bad. We know that's bad. You cannot provide a service whether or not it's free. If you provide a service to your IRA, your IRA dies and that's a very expensive proposition. So what's the problem? The word services has not been defined. We know we can't provide winter IRA, but the IRS has told us let's a service.

John Hyre: So here I got three questions for you. Question one, if you're signing leases for tenants and interviewing tenants and sort of doing the paper part of the management for a rental property and your IRA, is that a service? More on point could it be? Could it be a service? It could be because we don't have a definition. So could the tax court say that's a service. Yeah. And if they do, you're dead. Could managing a rehab, directing the rehab, designing and bringing together the subcontractors, running the subcontractors. Could that be a service if you do it for your IRA? Yeah. It's called being a general contractor. That could be a surface. Last but not least, because managing a LLC on behalf of your IRA to be a service, it could be so if you're going to use these LLCs and they have uses, if you're going to use an llc, I, I prefer to call it an IRA owned LLC and I do set them up.

John Hyre: I prefer that someone else be the manager, but that does create more moving parts and more complexity. You're involving another carbon based life form who creates risk and you have to communicate with them, but I, because of the risk issue on services, I normally prefer to see a separate manager for the llc. If you're going to self manage the llc, the checkbook, llc, then all you should be doing is writing checks and directing other people. That's it. If you're going to self manage, all you do is write checks and keep the risk low. As soon as you start doing other stuff and that llc, there is risk. And let me tell you this, those of you who are listening, who have checkbook, LLCs, nobody trains you on how to use them for the training was brief and inferior. I charge 2,500 bucks to set those up. Why? Because I take the time about three hours, to talk to you and train you on how to use it. And I also customize the agreement and my customized. I don't mean enter your name and date and print, which is what most of these yahoos do. So if you want to do it right, give me a call. What do I think about checkbook LLCs? Most of the ones out there are templates and most of those are garbage and you probably shouldn't be self managing.

JP Moses: We used you to set up our llc by the way. No one here knows that. So for what it's worth, um, next question, we have a circles back to the non entity asset protection part of our discussion. Um, this is from curt, he says, do you recommend an umbrella policy and will it work with properties not titled the same? IE land trusts with different LLCs as beneficiary, but same owner of all LLCs.

John Hyre: Alright, well, let's clarify a few terms. Um, umbrella policy. What most investors really mean by that is liability insurance, right? An umbrella policy. Technically speaking, is a policy that covers gaps. Let's say you have five houses with five different insurers. An umbrella would cover anything those five insurers don't. What most people mean by umbrella is really liability insurance. Think you should have it. Oh my god, yes. And people say, well, should I have that or an llc? Oh, now. Really matters. You've got to talk to someone who knows what they're doing. Here's who I recommend. There's a guy named Tim Norris, Tim Norris out of Kansas City, and I don't have the name of the company on, on the top of my head. He understands this stuff and you can save you money. For example, my mobile home parks, even though they were titled in different LLCs, he got me a policy that covered all four of them and the price was way better than doing them separately one of the times and he understands land trusts. The important thing. When you're doing a looks like you've got to pop up there on your screen. The important thing, oh, she's hot. Wow. What's on your computer?