Can You Hear Me?!?

Hey, [memb_contact fields=”FirstName”]! So over and above your core training, these sessions are designed to “amplify” or “amp up” your Investor Profits on Demand endeavors. These are key, important topics we've specifically chosen because:

Hey, [memb_contact fields=”FirstName”]! So over and above your core training, these sessions are designed to “amplify” or “amp up” your Investor Profits on Demand endeavors. These are key, important topics we've specifically chosen because:

(i) they're relevant, and (ii) they matter.

Basically it's all awesome stuff you'll love, but that we just didn't want to cram into the already-robust core sessions.

One quick thing: These amp sessions are time-released. Meaning they'll be opened up and available to you once the related core training is released to you. So if you're looking for a specific session you remember us talking about, but don't see it here — relax, Kemosabe, you'll see it in due time 🙂

Oh, and as always, please feel ask questions, interact with us or leave snarky remarks in the comments below each session. We dig that.

So let's do this…

IPOD Amplifier Trainings

Start Here: Amp #1 to Prep You for IPOD »

Amp » Your Dream Team on Demand

In this session we'll walk you through some practical steps of how to find, interview and select the essential members of your real estate dream team.

In this session we'll walk you through some practical steps of how to find, interview and select the essential members of your real estate dream team.

Whether you're brand spanking newbie or you've been doing real estate deals for decades – the fact is every investor needs the help of knowledgeable pros you can rely on as key players on your REI team.

These are the folks you surround yourself with and rely on for professional, investor-sensitive services, advice and guidance, and they are most certainly not all created equal.

Clearly choosing the right players vs. the wrong players for your team can make a huge difference to your overall success and your bottom line. Which is precisely why we're handing you our own “best practices” on a silver platter here! Enjoy…

Your 'Module 1' Amp Sessions »

Amp » The Life Cycle of a Budding Real Estate Investor

Realize it or not, those first few years getting your feet wet in real estate investing are pretty key for you. And in this session we'll take a look at the biggest common mistakes most investors tend to make in these formative years, and how to avoid them.

We'll also illuminate a better path you can choose (with a shorter, less painful learning curve), and the “best practices” you'll need to follow to make it happen.

From how you handle info overload, to bright shiny object syndrome, to the “toolbox” approach, to finding your “sweet spot” REI niche… If you're in your first few shaping years as an investor, this training should really help connect the dots in an encouraging, helpful way for you. Enjoy…

Amp » Learning Curve Crusher:

Real Life Lessons Learned From the REI Trenches

This is an open confession of the biggest, most painful mistakes I've made in my real estate investing biz over the years up to now — and boy, have I made some doozies.

This is an open confession of the biggest, most painful mistakes I've made in my real estate investing biz over the years up to now — and boy, have I made some doozies.

Why spill it all out in the open like this for you? It's simple: So you can learn from them. To help you avoid experiencing the same scrapes, bruises and gut-punches I got.

Now keep in mind… everyone makes mistakes, period. Whether you're brand new to the real estate game or a seasoned veteran, no one's perfect and no one's immune to your fair share of mistakes. It will happen.

But it's how you choose to respond, how you react, and what you learn along the way… that makes the difference. Oh, and not necessarily making the exact same mistakes other have already made before you, and are willing to openly share — like me! Enjoy…

Bonus Amp » Pushing Your Limits – Must Watch!

I guarantee this session will seriously challenge you on breaking through some of the limitations you find yourself shackled with right now.

I guarantee this session will seriously challenge you on breaking through some of the limitations you find yourself shackled with right now.

Don't be surprised when suddenly it all just “clicks” in your mind. So darn simple… but it's gonna make a huge difference in the way you approach things, especially in terms of reaching your elusive goals.

Oh, and I should say that it's not about real estate at all. But frankly I believe this is the single, biggest underlying reason why most people don't make it in real estate. And hey, it's actually a pretty easy fix, which you'll hear first hand just a few minutes into the video.

Ever wonder how in the world two people can both get the very same real estate course, learn the exact same stuff, and yet, one makes it big and the other falls by the wayside? It's not a coincidence — and you'll see it plain as day in this amp session. Enjoy…

Your 'Module 2' Amp Sessions »

One of the biggest, most common stress points for a lot of investors is being able to accurately analyze a real estate deal and confidently assess whether this property is a deal or a dud.

One of the biggest, most common stress points for a lot of investors is being able to accurately analyze a real estate deal and confidently assess whether this property is a deal or a dud.

In this session we're going to tackle it head on, and succinctly demystify and simplify the process of analyzing deals for you. You'll learn the essentials of knowing your ARV, best practices for pulling, viewing and reading comps, and even a “cut and paste” template for getting Realtors to pull all your comps for you.

We'll also do a “Repair Cost Crusher” session, revealing how you can learn to assess repairs on any house in 15 minutes or less, and two ninja “hacks” for learning actual repair costs in your area very quickly.

Bottom line, this one's all about boiling deal analysis down to it's essence for you, so you can confidently assess your Investor Profit on Demand deals. Enjoy…

Amp » Additional Sources of Deals

This session is intentionally concise and to-the-point at only 13 minutes long. Short and sweet.

This session is intentionally concise and to-the-point at only 13 minutes long. Short and sweet.

Why so skinny? Because it's an add-on to your Deals on Demand core training, which teaches you the primary and most important source of deals for the Investor Profits on Demand system — finding “unexpected owners” through DBP. We definitely recommend you implement DBP first and foremost.

Once you've done that, then this session will hand you a handful of other powerful, proven deal-getting methods that also work really well for us. These are actually being used actively in our real estate investing business. Enjoy…

Amp » Deal Analysis on Demand Software – How to Use

In this session we'll introduce you to your new Deal Analysis on Demand software, and walk you through and overview of how it's used.

In this session we'll introduce you to your new Deal Analysis on Demand software, and walk you through and overview of how it's used.

This software is a huge time saver and can really help you crunch your numbers quickly and accurately. It was crafted by our good friend and fellow dealmaker Daniil Kleyman, who you'll meet in the video.

Daniil originally crafted this software for his own real estate investing business. We were so impressed with it when he shared it with us, that we then convinced him to let us share it here with you privately.

Daniil's heritage is Russian, so we can neither confirm nor deny that a certain amount of Vodka may or may not have been involved 😉 Enjoy…

Amp » Purchase & Sale Agreement Walk Through

We hear from people all the time how intimidating the paperwork side of a real estate transaction can be if you're not used to it. How do you know whether you're using he right type of contract, with all the right clauses in place?

We hear from people all the time how intimidating the paperwork side of a real estate transaction can be if you're not used to it. How do you know whether you're using he right type of contract, with all the right clauses in place?

So in this session we'll gingerly walk you, step by step, through a simple, time-tested, proven contract we use in our own business. We'll go through it line by line with you, and not only show you how to fill it out, but also explain exactly what each term actually accomplishes for you (as an investor).

It won”t take long, because it's an intentionally short, plain English contract. And it's perfect for your DBP deals of course. Enjoy…

Your 'Module 3' Amp Sessions »

Amp » Additional Sources of Buyers

In core session 3 (Buyers on Demand) we showed you exactly how to build your cash buyers list using DBP. We were intentionally focused on that one method in your core session — mainly because we're not trying to go a mile wide and teach you every possible thing about every way you can skin a real estate cat. This will only overwhelm or confuse you. Instead we're going an inch wide and a mile deep for the most part.

In core session 3 (Buyers on Demand) we showed you exactly how to build your cash buyers list using DBP. We were intentionally focused on that one method in your core session — mainly because we're not trying to go a mile wide and teach you every possible thing about every way you can skin a real estate cat. This will only overwhelm or confuse you. Instead we're going an inch wide and a mile deep for the most part.

That said, we would like to go ahead and share a few other solid, proven ways you can amp up your buyers list, in addition to what was already covered in core training 3. Not to distract or confuse you — but to build upon it later.

So this amp session is intentionally super simple… In fact, it'll probably be the simplest and quickest video you'll go through, as we lay out two more easy, effective, low cost ways you can add even more buyers to your buyers list. Enjoy…

Amp » Your DBP Buyer & Seller Leads Storage System

Today we're going to give you a simple, but elegant way to keep track of all your buyer and seller leads that come through your Investor Profits on Demand endeavors.

Today we're going to give you a simple, but elegant way to keep track of all your buyer and seller leads that come through your Investor Profits on Demand endeavors.

Actually, we're going to share two methods with you: the first is a simple template you can download and start using right away at no cost, and the second is a more robust and elegant approach (and pretty darn cool too) but it costs a little to deploy – but not much really, and it's totally optional. But it's such a cool little tool, we felt it was too good to not share with you.

We also have a special surprise guest joining us for this session – you may or may not know him, but he's a close friend and a machine of an investor. Be ready to take lots of notes on this one. Enjoy…

Your 'Module 4' Amp Sessions »

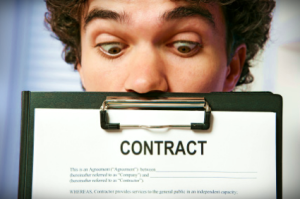

Amp » The 4½ Hour Profit on Demand Workweek

You've probably at least heard of The 4-Hour Workweek by now. Powerful stuff. But seriously, can it really be done? Can anything like that actually be achieved in a real estate investor's business? The answer may surprise you…

You've probably at least heard of The 4-Hour Workweek by now. Powerful stuff. But seriously, can it really be done? Can anything like that actually be achieved in a real estate investor's business? The answer may surprise you…

In this session we're going to pull the curtain back on Patrick's business, past and present, and demonstrate specifically how he's artfully leveraged different people and systems to craft a business that actually runs like a business (with him as CEO) and still affords him the chance to enjoy actually living his life.

We're talking about a guy who holds a number of cash flow rentals, flips a few deals a month, teaches and coaches others, and still has plenty of free time to skateboard around town, sip ice coffee and horse around on the beach every week.

What does it take to craft a profitable business that for the most part runs without your hands pulling all the levers and turning all the gears? A “lifestyle business” that requires only about an hour a day of your personal time, and half an hour or so on Friday? That's exactly what Patrick's done, and in this amp session he'll lay it all out for you, blow by blow. Enjoy…

Amp » Assignment of Contract Walk Through

In this sessions we'll take an up-close look at the Assignment of Contract agreement.

In this sessions we'll take an up-close look at the Assignment of Contract agreement.

This will not be a long training, as it's a pretty darn simple document. But don't be fooled into thinking it's not important. Truth be told this is one of the most key, essential docs in your REI tool chest. You need to understand how it works, why it works, and the best practices for using it.

So that's exactly what this session's all about, including giving you our very own contract assignment that you can start using on your own deals if you want. Enjoy…

Amp » The Shady Seller Lockdown Trick

In this session we'll reveal a sneaky (but 100% ethical) way to protect yourself in any transaction from an unscrupulous seller who might try to weasel out of your deal.

It could be because he's changed his mind on the contract and wants to fish around for better offers… or maybe a sleazy investor is trying to snipe your deal out from under you… or maybe the seller just flat out decides he doesn't like you any more for whatever reason (as happened to me) and doesn't want to honor his agreement anymore…

Regardless of the reason, you do have a viable option to protect yourself and lock down your deal and your profit. We've both deployed this little trick in the past and it's made all the difference. Enjoy…

Amp » Debt Free Investing: The “Free & Clear in 5” Framework

In this session we're digging into a concept together that may have seemed to you like Fantasy Land wishful thinking up to now… but we're going to make it oh-so-tangible and real for you.

This is all about how (and why) to invest in real estate without the slavery of debt attached to it. Meaning, no lender payments at all – zero, zilch.

We're going to share a lot about the philosophy behind this (including debunking the “Good Debt, Bad Debt” myth). And then we're also going to teach you three time-tested, proven strategies you can realistically deploy to make it happen for you. And no, not twenty years from now when you're rolling in it…I mean starting now or in the near future).

If you love owing people money and being on the hook for monthly payments, then this one's not for you. For the rest of us, prepare to have your paradigms shaken and mind expanded. Enjoy…